For

VanEck: Leading Global Investment Solutions and Innovative ETFs

For over six decades, VanEck has operated at the cutting edge of global investing, consistently bridging innovation with investor needs. Known for its pioneering exchange-traded funds (ETFs) and diversified investment products, VanEck has built a reputation as a trusted partner for both individual and institutional clients. As the financial world pivots towards more complex and accessible solutions, firms like VanEck are indispensable in democratizing robust investment strategies, from equities to emerging asset classes.

VanEck’s strategic choices and commitment to education, transparency, and forward-thinking product design place it in a unique position amid industry shifts and digital transformation. From the early launch of gold-based mutual funds to recent forays into digital asset ETFs, VanEck’s evolution mirrors broader trends shaping global markets today.

VanEck’s Legacy and Approach to Asset Management

Historical Milestones

Founded in 1955, VanEck began by helping investors gain access to international markets. Its initial gold fund, launched in 1968, responded to soaring demand for alternative investments and inflation hedges. This product set the tone for VanEck’s continued focus: anticipating investor sentiment and offering vehicles that match new market realities.

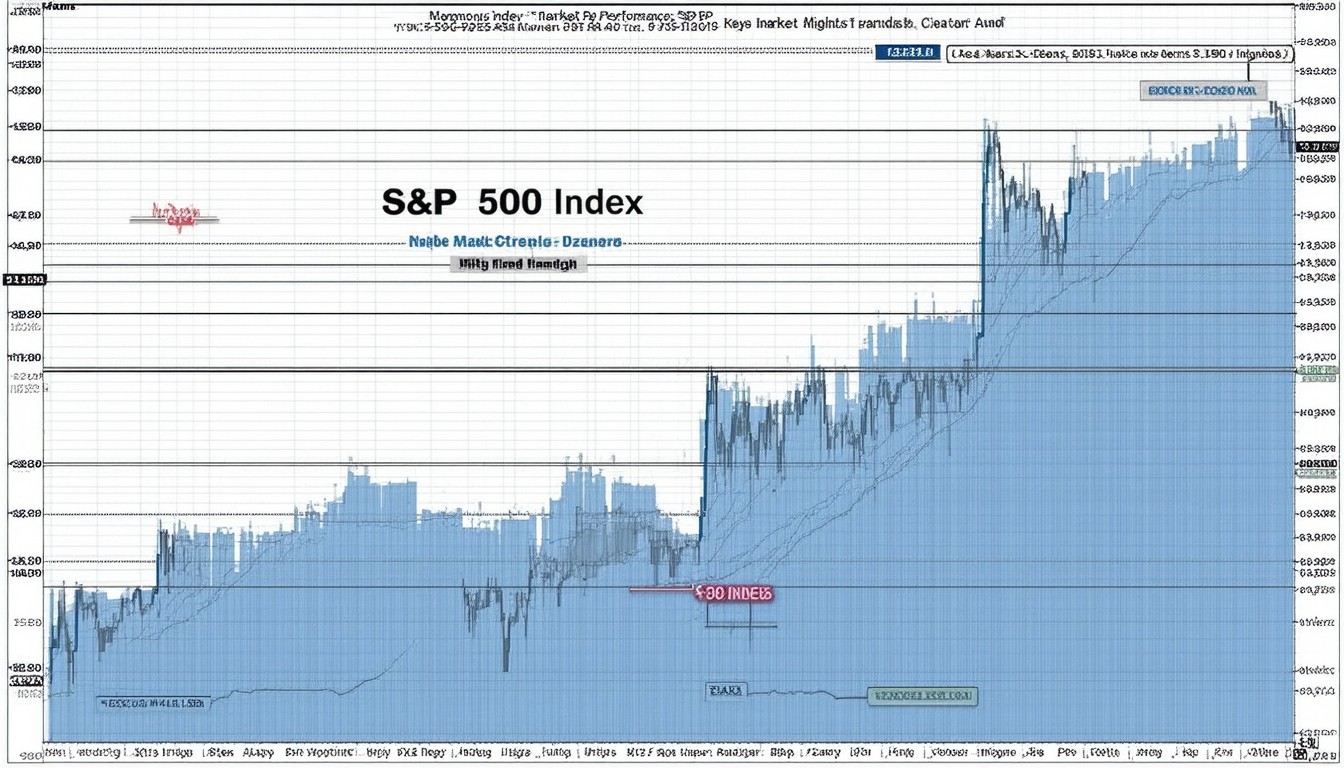

In the early 2000s, VanEck capitalized on the shift towards ETFs—a move that would greatly expand its reach. The introduction of purpose-driven ETFs, such as the VanEck Gold Miners ETF (GDX), positioned the firm as a forerunner in thematic and commodity-based investing. Today, VanEck manages a suite of funds spanning equities, fixed income, commodities, and digital assets, with a presence in North America, Europe, and Asia-Pacific.

Investment Philosophy and Product Innovation

VanEck’s core philosophy has been to empower investors with forward-looking, often contrarian solutions. This means:

- Exploring underrepresented asset classes: From emerging markets debt to digital assets.

- Using ETFs to enhance accessibility and liquidity.

- Building thematic portfolios around global trends, such as green energy or blockchain.

Catherine Wood of Ark Invest encapsulates the impact of such strategies:

“ETFs have fundamentally changed the way people invest—firms like VanEck are setting the pace for access to once-unreachable themes without the traditional structural barriers.”

The Expanding Universe of VanEck ETFs

Thematic and Niche Market Access

As ETF adoption accelerates globally, VanEck remains at the forefront of thematic innovation. Its offerings reflect current and anticipated shifts in market behavior:

- Commodities: Products like the VanEck Gold Miners ETF offer exposure to miners, not just the raw commodity, creating a nuanced risk-return profile.

- Emerging Markets: VanEck was among the first to bring specialized emerging market bond and equity funds to retail investors, expanding access beyond institutional circles.

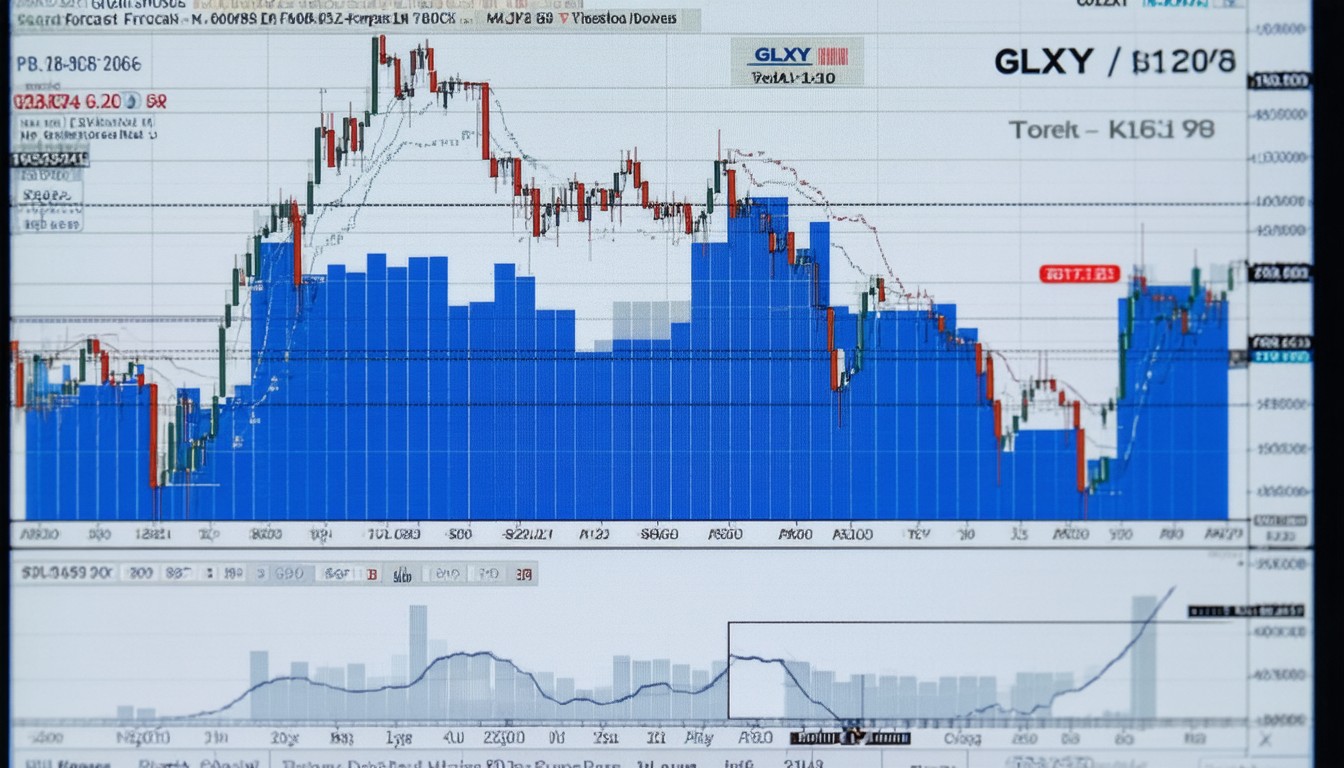

- Digital Assets: Recognizing the demand for regulated exposure to cryptocurrencies, VanEck has launched both spot and futures-based funds, providing plausible digital asset entry points for traditional portfolios.

For investors wary of individual security selection, VanEck’s thematic and sector-specific ETFs offer a streamlined way to align investments with macroeconomic trends or evolving technologies.

Liquidity, Transparency, and Cost Efficiency

ETFs offer more than thematic access. VanEck prioritizes investor interests through:

- Daily transparency: Detailed fund factsheets, portfolio holdings, and risk metrics are updated regularly.

- Competitive fees: VanEck strives to price products below or in line with industry averages, reinforcing value for cost-conscious investors.

- Robust liquidity: Many VanEck ETFs enjoy significant trading volumes, resulting in narrow bid-ask spreads and efficient entry/exit points, even in volatile markets.

Responsible Investing and ESG Integration

Growing Commitment to ESG

Sustainability and responsible investing have become pillars in modern asset management. VanEck has expanded its ESG (environmental, social, and governance) product range, offering ETFs and mutual funds that adhere to rigorous sustainability criteria. These strategies integrate exclusions (e.g., tobacco, controversial weapons), conduct ESG screening, and often include active company engagement.

Regulatory Alignment and Reporting

Navigating diverse jurisdictions, VanEck maintains compliance with evolving ESG regulations such as the EU’s Sustainable Finance Disclosure Regulation (SFDR). Investors are provided with transparent disclosures and impact reports, supporting informed decision-making.

This dual emphasis on investor value and societal impact reinforces VanEck’s role as both innovator and responsible steward.

Digital Assets, Blockchain, and the Future of Investing

Early Adopter in Digital Asset Innovation

In recent years, VanEck has solidified its reputation for agility by launching several digital asset investment vehicles. It was one of the first mainstream managers to offer Bitcoin and Ethereum futures-based ETFs—products that blend traditional regulatory oversight with exposure to transformative, high-growth technologies.

Educating Investors Amid Volatility

Navigating cryptocurrency volatility and evolving regulatory clarity remains a challenge. VanEck has responded with comprehensive educational initiatives—webinars, white papers, multimedia guides—enabling investors to grasp digital asset fundamentals and associated risks.

“The convergence of traditional finance and digital assets requires investors to prepare for a new era. Firms like VanEck help bridge the knowledge gap and deliver institutional-grade access to emerging technologies,” notes a senior ETF strategist at a leading global exchange.

Real-World Examples: Blockchain and Beyond

Beyond pure digital asset exposure, VanEck’s blockchain-themed ETFs allow investors to benefit from companies at the forefront of financial technology, supply chain reconfiguration, and digital infrastructure innovation.

Global Perspective and Investor Services

International Reach, Local Expertise

With regional offices and distribution partners across North America, Europe, and Asia, VanEck is able to tailor solutions to varying regulatory frameworks and investor demands. European clients, for instance, benefit from UCITS-compliant ETFs, while U.S. and Asia-Pacific markets enjoy a mix of actively managed and index-linked products.

Client Education and Custom Solutions

Modern investors expect more than just product access. VanEck addresses this by offering:

- Investor education initiatives: Seminars, market insights, and thematic research.

- Custom portfolio construction tools: Interactive platforms that help advisors and institutions build diversified models using VanEck funds.

In an era that demands customization and clarity, these services deepen trust and support long-term client relationships.

Conclusion: VanEck’s Strategic Role in Shaping Tomorrow’s Investment Solutions

VanEck stands out for its blend of tradition and innovation, a balance that has fueled growth and lasting relevance. By championing access to cutting-edge themes, from ESG criteria to digital assets, VanEck shapes not just portfolios but also the future of investment itself. For investors and institutions eyeing global diversification, cost efficiency, and new assets, VanEck’s products and educational resources form a powerful toolkit. Forward-focused, yet anchored in experience, VanEck is poised to remain a key architect of next-generation investment strategies.

FAQs

What types of products does VanEck offer?

VanEck provides a wide array of products, including ETFs, mutual funds, and institutional strategies covering equities, fixed income, commodities, and digital assets. Their focus is on both traditional and innovative investment solutions.

How does VanEck incorporate ESG principles into its funds?

The company integrates ESG criteria by screening holdings, excluding certain sectors, and offering dedicated sustainable funds. Transparent reporting ensures investors can assess the impact of their investments.

What distinguishes VanEck’s ETFs from others in the marketplace?

VanEck is recognized for pioneering access to niche markets and emerging themes with competitive fees and strong liquidity. Their commitment to transparency and investor education also sets them apart.

Is VanEck involved in digital assets and cryptocurrencies?

Yes, VanEck offers ETFs and funds providing exposure to digital assets like Bitcoin and Ethereum, as well as broader blockchain technologies. Educational resources help investors navigate this evolving space.

Where does VanEck operate globally?

The firm has a broad geographic reach, with offices and clients in North America, Europe, and Asia-Pacific. Products are tailored to local regulatory standards across these markets.

Cynthia Turner is a compassionate spiritual counselor and angel number interpreter with years of professional experience. She specializes in helping individuals navigate life transitions and discover their true purpose through understanding divine messages. Cynthia's empathetic approach combined with deep spiritual knowledge creates transformative experiences for her clients. She believes everyone has access to divine wisdom and her mission is to help others unlock this inner knowledge.