Matic

Polygon Price | Live MATIC Value, Chart, and Market Insights

The Polygon network, powered by its native token MATIC, occupies a pivotal space in the broader Ethereum scaling landscape. As a solution addressing limitations in speed and cost on Ethereum, Polygon has rapidly become influential within decentralized finance (DeFi), NFT marketplaces, and blockchain gaming. With this rising utility, many investors and industry watchers regularly scrutinize the live price of MATIC, its market trends, and broader implications for the evolving crypto economy.

Understanding Polygon: Foundation and Impact on Value

Polygon launched to address critical Ethereum limitations—namely, high transaction fees and network congestion. By serving as a layer-2 scaling solution, Polygon allows developers to build efficient and scalable applications, while end-users benefit from faster confirmation times and lower gas costs. The MATIC token underpins this ecosystem, playing a dual role as both the transaction fee medium and staking asset for securing the network.

Polygon’s integrated support for large-scale projects has helped drive adoption. Major DeFi protocols, such as Aave and Curve, have extended their offerings onto Polygon, while global consumer brands and blockchain game studios have started building on the platform. Collectively, these integrations contribute to regular, organic demand for MATIC, reinforcing its price stability and long-term value proposition.

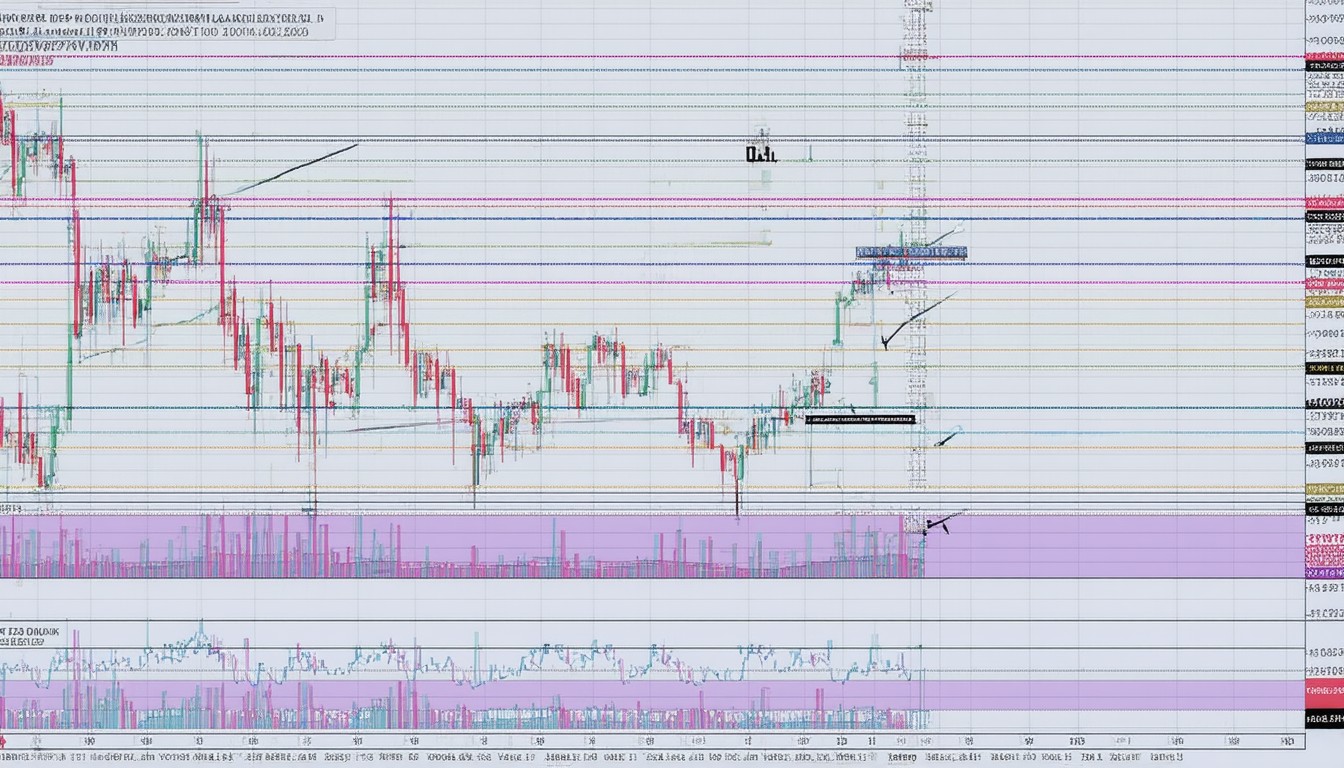

Polygon Price Chart: Live Data and Historical Patterns

MATIC’s price journey has traced the broader narrative arc of the crypto sector: initial speculative surges, periods of retracement, and episodes of renewed investor interest. While precise live values fluctuate constantly, the Polygon price has demonstrated several recurrent characteristics:

- A history of swift responses to network upgrades and high-profile partnerships

- Volatility in tandem with Bitcoin and the wider altcoin market

- Occasional price surges following major DeFi migration events

On-chain data underscores these observations. Wallet activity and transaction throughput on Polygon often spike after project launches or major blockchain events, creating corresponding upward momentum in MATIC’s value. Conversely, macroeconomic uncertainty or sector-wide corrections can dampen buyer enthusiasm, resulting in price dips.

Factors Influencing MATIC Market Performance

Multiple forces shape the market outlook for MATIC. Some of the most influential inputs include the following:

Network Growth and Adoption

Polygon’s transaction volume and active user base are key gauges of its health. When decentralized applications (dApps) and marketplaces onboard Polygon for speed and affordability, the overall ecosystem benefits.

“Polygon’s consistent onboarding of blue-chip DeFi protocols has established it as the preferred scaling option for developers and users seeking to avoid Ethereum’s high gas fees,” noted blockchain strategist Aditi Sinha in a recent industry panel.

Tokenomics and Supply

The MATIC token has a capped supply, with regular token releases scheduled and substantial portions allocated for network security and ecosystem support. The scarcity effect can impact price positively, especially during periods of heightened usage.

External Catalysts

Announcements regarding collaborations, mainnet upgrades, or integration with Web3 giants often lead to sharp inbound price reactions. For instance, integrations with gaming projects or NFT platforms have historically coincided with increased MATIC trading volumes.

Market Sentiment and Macro Trends

As with most digital assets, MATIC’s price is intertwined with overall crypto sentiment, regulatory headlines, and global market cycles. Extended bullish runs in Bitcoin or Ethereum tend to boost MATIC, while risk-off events can produce synchronous declines across the board.

Technical Analysis: Reading MATIC’s Current Price Action

A well-structured technical analysis of Polygon price typically employs tools such as moving averages, volume trends, and support/resistance mapping.

- Short-to-mid-term trends: MATIC often exhibits momentum trading characteristics. Breakouts across resistance zones (as seen during key adoption events) are typically accompanied by higher trading volumes.

- Long-term trajectory: Analysts frequently evaluate Polygon’s 200-day moving average as a marker for macro support or resistance, contextualizing investment decisions.

- Patterns to watch: Symmetrical triangles, bull flags, and pullbacks to prior resistance-turned-support zones have been recurring chart formations in MATIC’s price history.

In the current trading environment, traders keep a close eye on the interplay between rising Polygon adoption and broader market factors, with many viewing dips as potential entry opportunities—contingent, of course, on sound risk management and portfolio diversification.

Real-World Use Cases: The MATIC Utility Narrative

Polygon’s appeal extends well beyond speculative trading. Its real-world adoption provides a foundation for sustained MATIC demand:

- NFT Marketplaces: Several startups and established platforms, aiming to bypass high Ethereum fees, now mint NFTs on Polygon to offer users affordable and environmentally friendly alternatives.

- DeFi Ecosystem: Protocols like QuickSwap and SushiSwap bolster Polygon’s TVL (total value locked), illustrating the platform’s utility for yield farming, swaps, and lending.

- GameFi and DAOs: Blockchain games leverage Polygon for smoother, low-cost transactions, driving daily user activity to new highs in some cases.

As blockchain-backed consumer experiences scale, the need for seamless and efficient infrastructure—hallmarks of the Polygon approach—can foster durable and recurring demand for MATIC tokens.

Risks and Considerations for Polygon Price Watchers

Engaging with MATIC, as with any cryptocurrency, requires a measured appreciation of risk. Notable areas of concern include:

- Regulatory uncertainty: Shifting attitudes toward crypto regulation, especially in major markets, can rapidly alter sentiment.

- Competition: Rival layer-2 solutions and sidechains, such as Arbitrum and Optimism, are vying for similar market share, which could fragment network effects.

- Network vulnerabilities: While Polygon has employed various security measures, exploits or downtime in smart contracts remain a sector-wide risk.

Understanding these realities enables participants to form balanced perspectives, blending optimism with prudence.

Conclusion: The Evolving Outlook for Polygon’s Price

Polygon and its MATIC token have established themselves as key pillars in the world of Ethereum scalability, attracting robust developer activity and user migration. MATIC’s price trajectory remains tightly tied to the growth of decentralized applications, real-world use cases, and overall crypto market health. For investors and observers alike, careful monitoring of both on-chain developments and macro trends will be essential in navigating future price movements. Looking ahead, Polygon’s role as a builder-friendly and interoperable sidechain positions MATIC as a digital asset to watch—albeit one best approached with due diligence and an eye on evolving industry risks.

FAQs

What is the primary utility of the MATIC token within the Polygon ecosystem?

MATIC serves as the transactional currency for network fees, incentivizes validators, and is central to staking and governance processes on Polygon.

How does Polygon differ from Ethereum?

Polygon operates as a layer-2 scaling solution on top of Ethereum, delivering significantly faster and cheaper transactions while still leveraging Ethereum’s security.

Can Polygon compete with other layer-2 networks?

Polygon faces competition from projects like Arbitrum and Optimism, but its established ecosystem and range of partnerships have given it notable momentum in the layer-2 space.

What factors drive significant changes in the Polygon price?

Announcements, increased token utility through new project launches, network upgrades, and overall cryptocurrency market sentiment all play major roles in MATIC’s price volatility.

Is MATIC a safe investment?

While Polygon’s fundamentals are strong, investing in MATIC carries the typical risks associated with cryptocurrencies, including regulatory and market uncertainties. Diversification and caution are advised.

Where can I access live Polygon price charts?

Real-time MATIC price data and charts are widely available on reputable exchanges and financial data sites such as Binance, Coinbase, and CoinMarketCap.

Established author with demonstrable expertise and years of professional writing experience. Background includes formal journalism training and collaboration with reputable organizations. Upholds strict editorial standards and fact-based reporting.