Market

PENGU Price | Live PENGU Token Value, Chart & Market Cap

The cryptocurrency landscape thrives on innovation, and tokens like PENGU have captured the attention of both casual traders and seasoned investors. As a community-driven asset, PENGU exemplifies several defining trends of the current crypto era: viral community growth, meme culture, and speculative trading layered with distinct project fundamentals. Understanding the forces behind the live PENGU price, its value dynamics, and evolving market capitalization is critical for anyone looking to interpret its performance or anticipate future movements.

Tokens similar to PENGU often spark swift price changes, creating both opportunity and risk. While headline volatility is eye-catching, a nuanced look at PENGU’s tokenomics, trading volumes, and development roadmap gives a clearer picture of its true market position.

Key Factors Shaping the Live PENGU Price

Community Momentum and Sentiment

PENGU, like most meme-inspired tokens, relies heavily on the strength and passion of its online community. Social sentiment has a direct and often immediate effect; viral tweets, trending hashtags, or influencer endorsements can ignite strong rallies or abrupt declines.

Beyond hype cycles, persistent community engagement—such as development activity, memes, staking opportunities, or charitable tie-ins—helps build baseline support and resilience against price drops. In practical terms, a vibrant Discord or Twitter presence can, at times, be as influential as a technical update or new partnership.

“The most successful meme tokens combine spirited online communities with active project stewardship,” notes blockchain analyst Maya Lee. “This synergy often sets the stage for outsized price appreciation, especially in early adoption phases.”

Token Supply, Liquidity, and Burns

The mechanics of a token’s supply play a pivotal role in its value. PENGU’s circulating supply, the total tokens available for trading, influences scarcity and the perceived price ceiling. Tokens with programmed burns—where portions are periodically removed from circulation—can see supply tighten over time, potentially supporting price increases, especially if demand remains steady or grows.

Liquidity, measured by trading volume and depth on exchanges, is equally vital. More liquid markets allow for smoother trades and less slippage, contributing to narrower bid-ask spreads and more stable price charts.

Broader Market Environment

Even the most vibrant PENGU community can’t insulate the token from larger market forces. Movements in Bitcoin and Ethereum often set the tone for the wider crypto market, impacting smaller tokens through capital flows and risk appetite shifts. During strong bull markets, speculative tokens frequently see outsized gains as risk tolerance expands; in corrections or bear markets, capital tends to consolidate into more established assets or exit the space entirely.

Relatedly, regulatory changes, exchange listings, and macroeconomic headlines can all act as price catalysts—or headwinds.

Tracking Live PENGU Token Value: Tools and Best Practices

Real-Time Data Sources

Staying informed about PENGU’s live price and market cap requires reliable data. Leading cryptocurrency aggregators like CoinGecko and CoinMarketCap offer up-to-the-minute price feeds, historical charts, and trading pair breakdowns. Many platforms also feature community ratings and on-chain analytics.

Pro-level traders may also track PENGU on decentralized exchanges (DEXs) through analytics platforms like DEXTools or GeckoTerminal. These tools not only provide liquidity pool data, but can also uncover the health of token holders, wallet distribution, and top buyer/seller activity.

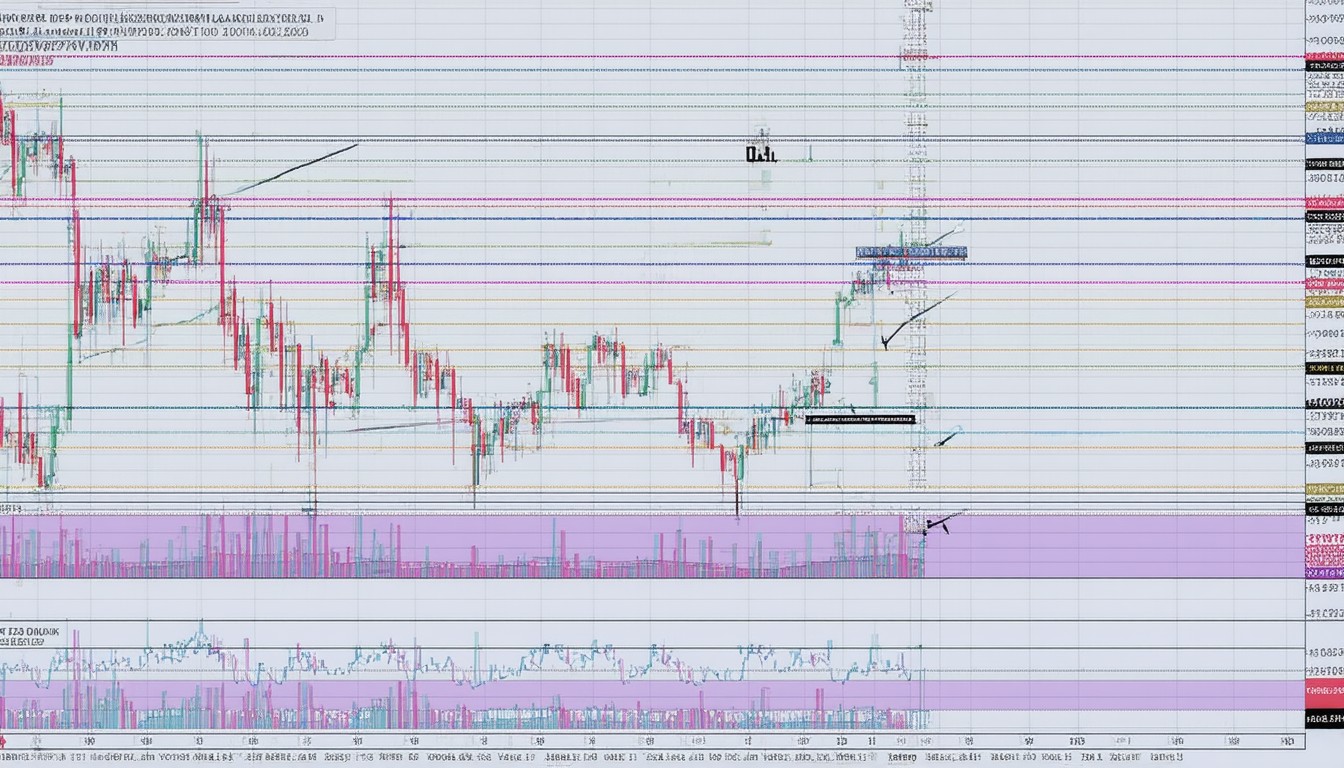

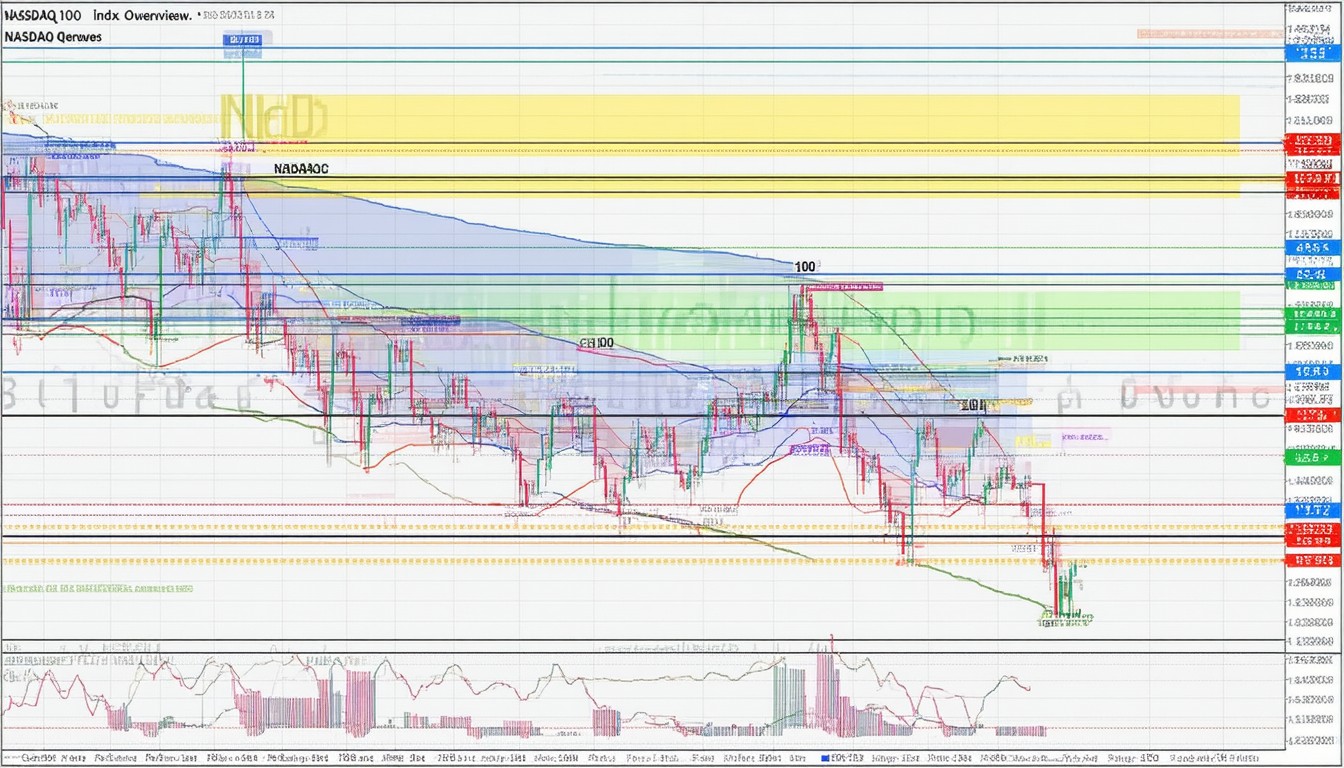

Reading Price Charts Effectively

Live price charts for PENGU highlight both short- and long-term sentiment shifts. Candlestick patterns, volume spikes, and moving averages help illustrate momentum, support, and resistance. In highly speculative assets, technical analysis is often used in tandem with real-time sentiment indicators: sharp price surges following a social media event, for instance, may fizzle as quickly as they began.

Savvy investors look for confirmations across multiple metrics—price, volume, order book depth—before making decisions.

Practical Risk Management

Because tokens like PENGU can be volatile, sound risk management is essential. Setting protective stop-losses, diversifying holdings, and only allocating risk capital are key practices for navigating sudden price shifts. Experienced traders also pay attention to token unlock schedules, vesting periods, and upcoming project milestones that could influence supply or demand.

PENGU Market Cap: Interpreting Size and Scope

Market capitalization, calculated as current price multiplied by circulating supply, serves as a rough barometer of a token’s size and impact. For PENGU, this metric contextualizes growth relative to both direct competitors and the wider meme sector.

Comparing PENGU Market Cap to Peers

While absolute market cap numbers fluctuate, comparing PENGU’s value to similar projects helps gauge maturity and upside potential. New entrants typically start with smaller market caps, leaving ample room for fast appreciation if adoption accelerates. Conversely, tokens that outgrow their initial viral surge sometimes stagnate without continued innovation or community reinforcement.

When analyzing PENGU, it is also helpful to observe market cap rank, liquidity on major exchanges, and concentration of holdings among top wallets.

Risks and Limitations of Market Cap in Crypto

It is important to remember that market cap in crypto, unlike equities, does not always reflect actual value. Thinly traded tokens or those with large portions held by insiders may see market caps that are technically high but fragile in practice. Large price swings from single trades can briefly inflate or deflate market cap without indicating genuine user adoption.

The Broader Meme Token Phenomenon: How PENGU Fits In

Growth of Meme Tokens

Since Dogecoin’s ascent, meme tokens have allowed communities to blend creativity with speculative trading. While countless copycats have launched, only a handful have managed to secure real staying power by evolving beyond their origins. PENGU positions itself within this landscape, leveraging viral appeal while pursuing ongoing development and ecosystem partnerships to remain relevant.

Sustainability and Project Fundamentals

Investors increasingly look for signs that tokens like PENGU are building sustainable ecosystems—such as staking, NFT integration, or real-world utility—rather than riding a passing trend. Projects able to transition from meme status to recognized brands or platforms have historically outperformed in the longer term.

Conclusion: Navigating PENGU’s Dynamic Price Landscape

The journey of the PENGU token demonstrates both the promise and unpredictability of crypto’s meme sector. Understanding the live PENGU price requires a multi-dimensional approach—one that factors in community actions, supply mechanics, technical analysis, and broader market flows. Those considering PENGU should combine real-time data monitoring with prudent risk management and a critical assessment of underlying project fundamentals.

Navigating this sector demands agility. As web3 evolves and new narratives emerge, PENGU’s market cap, value, and appeal will inevitably shift. Staying informed and maintaining a disciplined approach are the best tools for any participant, whether holder or observer.

FAQs

What exchanges can I use to buy or trade PENGU?

PENGU can typically be bought or sold on both centralized and decentralized exchanges that list the token. Popular options often include DEXs like Uniswap or platforms where meme tokens are trending.

Why does the PENGU price experience sharp volatility?

Price volatility in PENGU is driven by rapid changes in community sentiment, social media events, and broader market swings. Low liquidity or sudden large trades can exaggerate price movements in either direction.

How do I check the live PENGU token price?

The most accurate and timely price quotes come from reputable aggregators such as CoinGecko, CoinMarketCap, or analytics tools focused on the platform where PENGU is traded. These sites regularly update charts and volume data.

What factors influence PENGU’s market cap?

The market cap of PENGU is calculated by multiplying its current price by its circulating supply. Both fluctuating prices and token burns or unlocks can cause market cap to rise or fall.

Is PENGU a safe investment compared to larger cryptocurrencies?

While some investors value PENGU for its community and growth potential, meme tokens in general carry higher risk and volatility than established assets like Bitcoin or Ethereum. Consider these dynamics carefully when assessing risk.

Can the PENGU price recover after a major drop?

Price recoveries in volatile tokens depend on renewed interest, broader market sentiment, and new developments from the PENGU team. History shows that sharp drops are sometimes followed by rebounds, but sustained recoveries require more than hype alone.

Established author with demonstrable expertise and years of professional writing experience. Background includes formal journalism training and collaboration with reputable organizations. Upholds strict editorial standards and fact-based reporting.