Nvidia

NVDA Price | NVIDIA Stock Value, Market Trends & Analysis

NVIDIA Corporation (NVDA) has emerged as one of the most closely watched companies on Wall Street, with its stock price reflecting both the company’s innovation and the market’s voracious appetite for AI-driven growth. In recent years, NVDA’s valuation has soared, propelled by demand for its graphics processing units (GPUs) in fields far beyond gaming—encompassing artificial intelligence, data centers, autonomous vehicles, and high-performance computing. As of early 2024, NVDA price movements are under intense scrutiny by institutional investors, retail traders, and tech industry analysts alike.

Understanding NVIDIA’s stock value means looking past the ticker tape and deciphering what’s driving the company’s stratospheric run. This analysis explores the trajectory of NVDA’s price, pivotal market trends, and the metrics that traders and investors are tracking to evaluate future potential.

Core Drivers of NVDA Price Growth

AI Industry Tailwinds and Revenue Surge

The AI revolution has ignited explosive growth for NVIDIA’s data center segment. Major tech giants rely heavily on NVIDIA’s GPUs for training large language models and powering AI cloud services. As companies worldwide rush to integrate generative AI into products and services, demand for NVIDIA’s high-performance chips has far outpaced supply.

Beyond AI, NVIDIA’s market share in gaming GPUs remains robust, and its expansion into sectors like automotive, where its DRIVE platform supports next-gen autonomous vehicles, further underpins diversified revenue streams.

“NVIDIA’s relentless innovation places it at the epicenter of the AI gold rush, making it a core holding for investors seeking exposure to transformative technology,” says Doug Clinton, Managing Partner at Loup Ventures.

Financial Performance and Market Reaction

NVIDIA’s recent earnings reports consistently surpass Wall Street expectations. The company recorded record-breaking revenue in its latest quarters, with margins that outstrip many semiconductor peers. Across these earnings cycles:

- Revenue growth has seen double-digit year-over-year increases, with the data center unit leading the charge.

- Gross margins have remained strong, reflecting NVIDIA’s pricing power amid high demand.

- Analysts have responded by steadily increasing their price targets and earnings forecasts.

Market participants closely monitor NVDA’s guidance, as management often signals demand trends and future product launches that influence investor sentiment.

Valuation Metrics: Balancing Momentum and Caution

NVDA’s price-to-earnings (P/E) and price-to-sales (P/S) ratios remain significantly higher than semiconductor industry averages. Proponents argue these valuations are justified given the company’s growth rate and dominant AI position; detractors warn of frothiness reminiscent of past tech bubbles.

To navigate this, institutional buyers look for leading indicators such as:

- NVIDIA’s product pipeline, especially competitive responses to AMD and Intel advances.

- Supply chain bottlenecks or shifts in geopolitical risk that may affect manufacturing.

- Signs of saturation or cyclical weakness in core end-markets like PC gaming.

Key Market Trends Shaping NVIDIA’s Valuation

Rapid Expansion of Data Centers and AI

Many of the world’s largest cloud providers—Amazon AWS, Google Cloud, Microsoft Azure—depend on NVIDIA’s chips to build scalable, AI-first infrastructure. The company’s H100 GPUs, specifically designed for large-scale deep learning processes, have been backordered by major customers.

NVIDIA’s CUDA ecosystem, a powerful software toolkit for GPU programming, secures its technological moat. This stickiness not only attracts enterprise developers but also ensures recurring enterprise spending.

Competitive Landscape and Sector Dynamics

While NVIDIA enjoys leadership in AI chips, the competitive environment is intensifying. AMD is ramping up its own accelerator solutions, and tech firms like Google and Amazon are investing in custom silicon for AI workloads.

However, NVIDIA’s scale, robust intellectual property, and avid developer community combine to create a competitive advantage that remains difficult to disrupt over the near-to-medium term.

Macroeconomic and Geopolitical Considerations

Like all large-cap tech stocks, NVDA price is sensitive to broader macroeconomic cycles. Rising interest rates, inflationary pressures, or trade tensions—especially between the U.S. and China—can introduce volatility. Restrictions on chip sales to certain markets, or disruptions in critical supply chains, have the potential to trigger sharp moves in NVIDIA’s valuation, even in the face of robust operational performance.

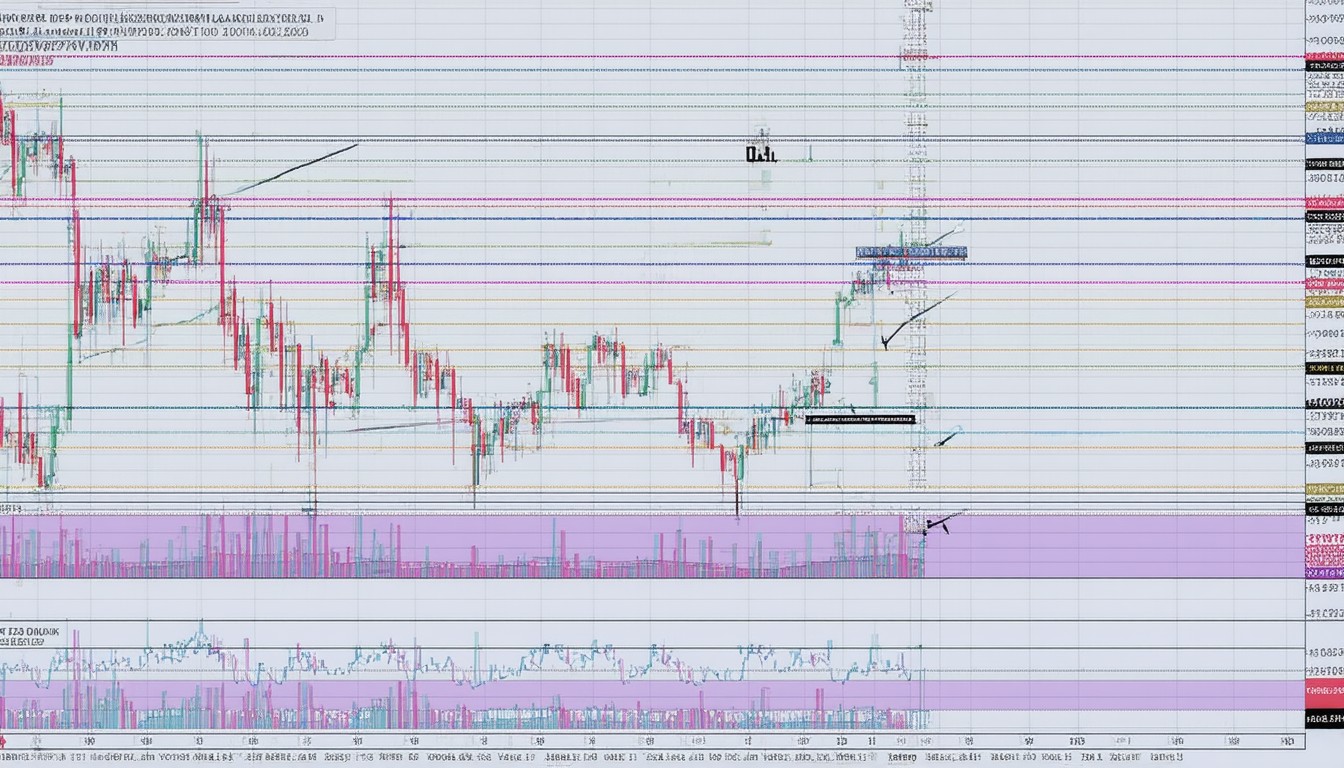

Technical Analysis: Reading the NVDA Price Action

Historical Performance and Key Support/Resistance Levels

NVDA’s price trajectory over the past decade has been extraordinary, outpacing most major indexes. The stock has seen periods of rapid escalation, brief corrections, and resilient rebounds—characteristic of high-growth tech equities.

Short-term traders often look at technical indicators such as:

- Relative Strength Index (RSI) to gauge overbought or oversold conditions.

- Moving averages (50-day, 200-day) to identify trend direction and momentum shifts.

- Volume spikes accompanying major news releases or earnings announcements as confirmation signals.

Investor Sentiment and Institutional Positioning

Growth-oriented exchange-traded funds (ETFs), including the Invesco QQQ Trust (QQQ) and various technology sector ETFs, maintain significant allocations to NVDA. This institutional ownership provides support but can also increase volatility during sector-wide rotations.

Individual investors, meanwhile, often look to social media and retail platforms for cues. Sudden surges in options activity or retail interest can drive short-term price swings, amplifying both upside potential and downside risk.

Real-World Context: Recognizing Inflection Points

The broader semiconductor sector increasingly mirrors macro themes — AI, digital transformation, and renewed investment in infrastructure. For instance, in early 2024, several U.S.-based cloud service providers announced multi-billion-dollar AI buildouts, directly benefiting NVIDIA’s bottom line.

Beyond headline numbers, attention also centers on NVIDIA’s diversification strategy. The company’s drive into industrial automation, healthcare imaging, and edge computing could set the stage for future growth, even as the market digests the full extent of AI’s current hype cycle.

Conclusion: Assessing Future Prospects for NVDA Price

NVIDIA stands at the intersection of multiple secular trends, positioning its stock as both a bellwether for tech innovation and a lightning rod for market speculation. Exceptional earnings growth, technological leadership in AI, and a well-monetized ecosystem underpin NVDA’s current price strength. Still, investors should weigh valuation risks, competitive shifts, and external macro headwinds.

For those considering NVDA, vigilance is crucial—tracking earnings updates, competitive moves, and macroeconomic signals is essential to navigate a stock as dynamic and influential as NVIDIA.

FAQs

Why has NVDA price increased so rapidly in recent years?

NVDA’s price surge is driven by soaring demand for AI chips, robust growth in data center revenues, and consistent financial outperformance. Its leadership in GPU technology places it at the heart of transformative trends in tech.

What risks could impact NVIDIA’s stock price going forward?

Risks include intensifying competition from other chipmakers, potential supply chain disruptions, changes in global trade policy, and market corrections linked to high valuations.

How does NVIDIA’s valuation compare to other semiconductor firms?

NVIDIA typically trades at higher price-to-earnings and price-to-sales ratios than many peers, reflecting its growth profile and dominant AI positioning. Some investors see this as justified, while others urge caution due to rich valuations.

What role do data centers and AI play in NVIDIA’s business?

Data centers and AI have become key revenue engines, as hyperscale cloud providers depend on NVIDIA’s chips to power machine learning and advanced analytics, shifting the company’s focus from gaming to broader enterprise applications.

Has NVIDIA diversified beyond gaming GPUs?

Yes. NVIDIA now operates in data centers, automotive technology, healthcare imaging, industrial automation, and edge computing—each adding resilience to its growth outlook.

How can investors keep track of NVDA’s price trends?

Investors can follow quarterly earnings, shifts in institutional ownership, product announcements, and technical indicators such as moving averages to monitor the stock’s trend and potential inflection points.

Certified content specialist with 8+ years of experience in digital media and journalism. Holds a degree in Communications and regularly contributes fact-checked, well-researched articles. Committed to accuracy, transparency, and ethical content creation.