Microstrategy

MSTR Price: Live MicroStrategy Stock Value, Chart & Market Analysis

:

Track the live MSTR price, analyze MicroStrategy’s stock trends, and uncover expert market analysis. Explore detailed charts, company context, and critical insights for informed investing.

MSTR Price Today: A Snapshot of MicroStrategy’s Stock Value

MicroStrategy Incorporated (NASDAQ: MSTR) has evolved into one of the most-watched technology stocks, largely due to its aggressive Bitcoin strategy. The live MSTR price reflects not only the company’s performance as a pioneering business intelligence firm but also its unique role as a de facto proxy for Bitcoin exposure. As investors seek real-time updates and deeper analysis, understanding MicroStrategy’s stock movement—on both fundamental and technical levels—has never been more essential.

Amid a volatile market environment, MSTR frequently experiences dramatic swings. This heightened volatility is driven by several intertwined factors: broader tech sector sentiment, fluctuations in the price of Bitcoin, and periodic moves by MicroStrategy itself to acquire more bitcoin as part of its treasury strategy.

Key Drivers Behind MSTR Price Movements

Several elements uniquely influence MicroStrategy’s stock, setting it apart from traditional tech equities.

The Bitcoin Factor: Company Treasury Strategy

Since 2020, MicroStrategy’s CEO, Michael Saylor, has set the company apart by converting much of its corporate treasury into Bitcoin. This strategy means the value of MSTR is now closely correlated to Bitcoin price fluctuations, with MSTR often moving in greater magnitude than BTC itself.

- Proxy for Bitcoin Exposure: Investors without direct access to cryptocurrencies can use MSTR as a stand-in, amplifying price movements as Bitcoin soars or plunges.

- Balance Sheet Impact: MicroStrategy holds one of the largest bitcoin reserves among public companies. This exposure can cause the stock to decouple from traditional earnings metrics.

Earnings and Business Fundamentals

While Bitcoin headlines dominate, MicroStrategy’s software business remains a significant pillar. Earnings releases, enterprise client wins, and cloud analytics growth still inform analyst expectations.

“MicroStrategy’s underlying business still matters—a strong quarter in software can curb volatility even when Bitcoin is turbulent,” notes one Wall Street tech analyst.

Company fundamentals, especially recurring SaaS revenue and new enterprise customer acquisition, offer some ballast, countering moments of intense crypto-driven speculation.

Market Sentiment and Media Coverage

The media spotlight on MicroStrategy, especially following high-profile Bitcoin purchases or statements from its leadership, tends to magnify swings in MSTR price. A bullish Bitcoin environment, paired with positive news coverage, typically triggers buying waves. Conversely, regulatory crackdowns, sharp crypto downturns, or negative industry news can spook investors.

External Economic and Regulatory Climate

Like other tech growth stocks, MSTR reacts to moves in interest rates, inflation data, and Federal Reserve signals. However, its outsized crypto exposure also leaves it vulnerable to changing regulatory attitudes towards Bitcoin and digital assets in major economies such as the US and EU.

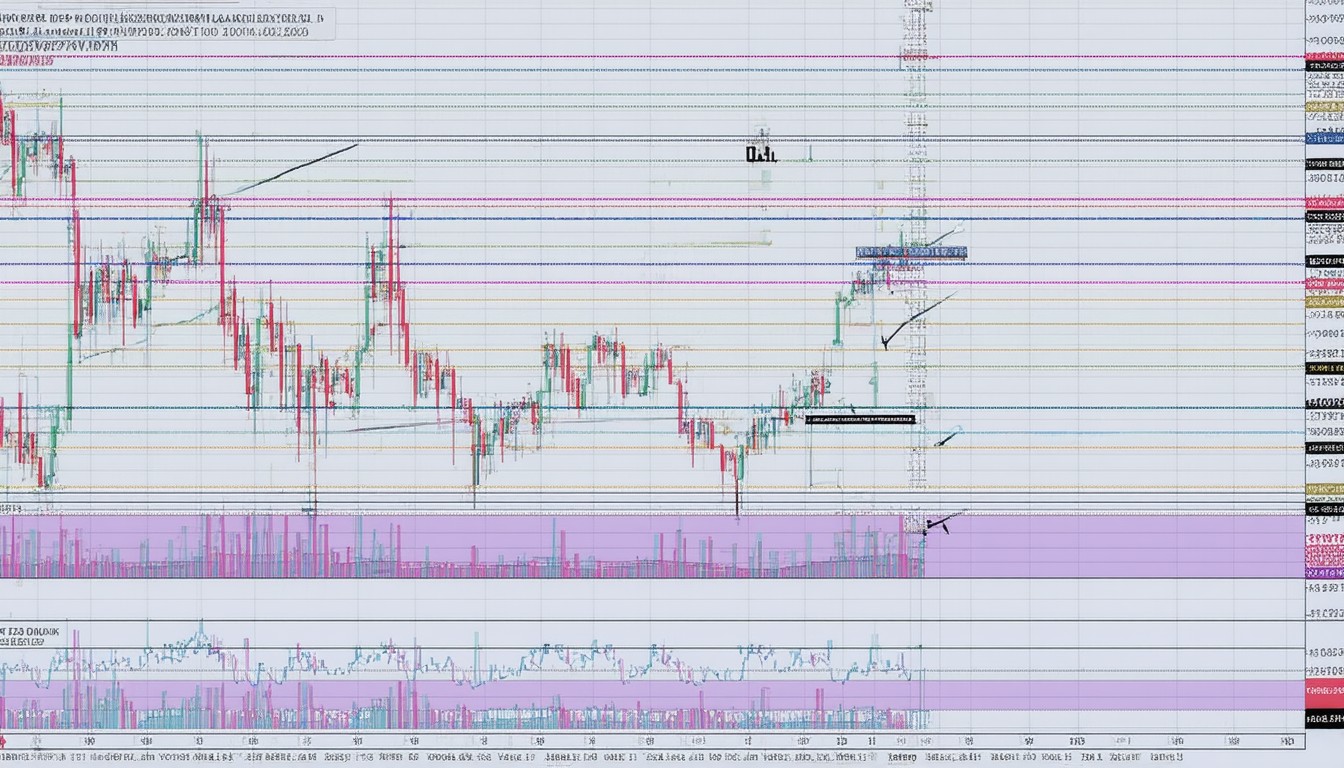

MSTR Price Chart Analysis: Reading the Trends

MSTR’s price chart tells a story of pronounced peaks and valleys, dancing to rhythms set by both the traditional stock market and crypto cycles.

Historical Price Patterns

- 2020–2021 Surge: As MicroStrategy announced its first major Bitcoin buy, the price of MSTR surged in tandem with the broader crypto bull run.

- Volatility in 2022: Broader tech sector declines and a crypto winter hammered MSTR; the stock suffered outsized declines relative to software peers.

- Recent Recovery: Renewed optimism around Bitcoin’s long-term potential, combined with more disciplined capital allocation, has contributed to a cautious bounceback.

Technical Analysis: Support, Resistance, and Momentum

Key support and resistance levels in recent trading can provide clues to future moves:

- Strong historical support tends to form near periods of heavy Bitcoin accumulation.

- Resistance often builds when traders anticipate profit-taking after bitcoin rallies.

Momentum indicators such as Relative Strength Index (RSI) and moving averages (20-day, 50-day, 200-day) offer traders further perspective on whether MSTR is overbought or oversold.

Example Scenario

Consider a week where Bitcoin surges 10%. Frequently, MSTR price moves double that, reflecting leveraged sentiment. When BTC corrects sharply, MSTR echoes the pain. This asymmetric performance can be both an opportunity and a risk, especially for retail investors.

MicroStrategy’s Business Fundamentals: Beyond Bitcoin

While MicroStrategy’s Bitcoin position draws daily headlines, its software solutions remain a critical—if sometimes overshadowed—component of its value.

Core Analytics & Cloud Business

MicroStrategy continues to serve Fortune 500 and global enterprise clients with cloud-based BI solutions. Its established track record in analytics ensures recurring revenues and client stickiness, even in volatile tech cycles.

Financial Health and Risk Profile

MicroStrategy’s decision to issue debt for Bitcoin purchases introduced both headline excitement and long-term risk. Debt-servicing capacity, future fundraising, and the use of convertible notes are now major points for analysts.

“MicroStrategy’s dual emphasis on software growth and digital asset acquisition creates a rare hybrid risk-reward profile for public company investors,” claims a veteran fintech researcher.

Institutional Ownership & Market Perception

Institutional holders—ranging from large asset managers to tech-driven hedge funds—have approached MSTR as both a value and speculative play. Fluctuations in institutional buying often precede trend reversals, making 13F filings and public ownership disclosures a useful supplementary data point.

Critical Considerations for MSTR Investors

Given its role at the intersection of traditional tech and cryptocurrency, investing in MSTR involves a unique set of considerations.

Pros

- Crypto-Equity Hybrid: Direct exposure to Bitcoin with the liquidity and governance protections of traditional stock.

- Innovation Leadership: Early-mover advantage in blending enterprise analytics and digital asset treasury.

- Media and Social Momentum: High visibility can translate to trading opportunities.

Cons

- High Volatility: Moves in Bitcoin create amplified, sometimes unpredictable, stock swings.

- Regulatory Sensitivity: Subject to both tech regulation and crypto-specific oversight risks.

- Debt Exposure: Leverage introduces downside risks if Bitcoin’s price sharply contracts.

Understanding these risks is crucial for both long-term investors and active traders.

Conclusion: Strategic Takeaways on MSTR Price

MicroStrategy’s live stock price is uniquely positioned at the crossroads of enterprise software and bitcoin investing. Its volatile chart, shaped by digital asset strategy and enduring software fundamentals, offers both high potential and amplified risk. For investors, MSTR is not simply a tech stock or a bitcoin fund—it is an evolving hybrid. Those seeking exposure should closely monitor Bitcoin’s outlook, earnings cycles, and macro trends.

As the interplay between crypto markets and traditional finance intensifies, MSTR’s price will remain a telling barometer for two of the most dynamic sectors in today’s financial world.

FAQs

What is driving the volatility in MSTR price?

MSTR price is highly sensitive to Bitcoin fluctuations due to MicroStrategy’s large holding of digital assets. Additionally, media coverage, earnings reports, and broader tech sentiment amplify this volatility.

Does MSTR stock always move in sync with Bitcoin?

While MSTR often tracks Bitcoin, its movements are sometimes exaggerated due to leveraged sentiment, unique business fundamentals, and external market events.

How does MicroStrategy’s business performance affect its stock price?

Strong performance in MicroStrategy’s software business can stabilize its stock during crypto downturns, but digital asset holdings usually drive the biggest moves.

What is the relationship between MSTR and other crypto-related stocks?

MSTR is more directly tied to Bitcoin price than most tech stocks, but shares similarities with other crypto-exposed equities like Coinbase or Tesla’s Bitcoin holdings.

Is MSTR a safe investment for non-crypto investors?

MSTR’s combination of enterprise software and substantial Bitcoin exposure means it carries higher risk and volatility than most traditional tech stocks. Investors should weigh their risk tolerance before investing.

Can MSTR price keep rising if Bitcoin’s price stagnates?

If Bitcoin remains flat, MSTR’s price may still benefit from strong earnings or strategic business developments. However, major moves are usually linked to cryptocurrency trends.

Experienced journalist with credentials in specialized reporting and content analysis. Background includes work with accredited news organizations and industry publications. Prioritizes accuracy, ethical reporting, and reader trust.