Jasmy

Jasmy Price | Live JasmyCoin Value, Market Trends & Analysis

Track live Jasmy price, discover real-time JasmyCoin value movements, and uncover the market trends and in-depth technical analysis shaping this IoT-driven cryptocurrency’s trajectory. Explore informed perspectives, risks, and opportunities in Jasmy’s volatile digital asset landscape.

Introduction: JasmyCoin’s Emerging Place in the Crypto Ecosystem

JasmyCoin (JASMY) has rapidly gained attention as Japan’s leading blockchain project focused on the Internet of Things (IoT) and data democratization. As new blockchain technologies disrupt traditional models for data privacy and exchange, JasmyCoin’s vision of secure data sharing places it in a unique niche. This digital currency’s value, often referred to as the “Jasmy price,” is determined not just by global market sentiment, but also by its expanding use cases and growing partnerships within industry and government. For traders, investors, and tech enthusiasts watching the space, understanding the factors moving the Jasmy price is essential for making strategic decisions.

Understanding JasmyCoin: Purpose and Technology

Launched in 2021, Jasmy is built on the Ethereum blockchain, leveraging the security and flexibility of ERC-20 standards. Jasmy’s primary mission is to enable individuals and companies to “own, control, and monetize their data”—a goal increasingly resonant in a world grappling with data breaches and privacy concerns.

Key Features Driving Value

- Decentralized Data Exchanges: Jasmy’s network allows users to safely share their IoT-generated data with businesses, receiving JASMY tokens as compensation.

- Enterprise Partnerships: Collaborations with major corporations, many of them in Japan’s advanced tech and automotive sectors, add credibility and drive ecosystem adoption.

- Regulatory Compliance: Compliance with Japanese financial and data protocols helps Jasmy stand out in a crowded field, mitigating some risks associated with regulatory uncertainty.

These fundamentals anchor JasmyCoin’s long-term value proposition, although its live price can fluctuate dramatically due to typical crypto volatility.

Live Jasmy Price: Influences and Dynamics

The Jasmy price is highly sensitive to various technical, market, and macroeconomic factors. Though daily trading volumes remain modest compared to blue-chip cryptocurrencies like Bitcoin or Ethereum, Jasmy often experiences pronounced swings, drawing both risk-tolerant investors and speculative traders.

What Moves the JasmyCoin Price?

- Market Sentiment: Like other altcoins, positive news (such as new exchange listings or partnership announcements) can cause brief surges in Jasmy value, while broader crypto sell-offs tend to erode prices rapidly.

- Trading Liquidity: Changes in JasmyCoin’s availability on major global exchanges—such as Binance or Coinbase—affect price discovery and volatility.

- On-Chain Metrics: Increases in the number of unique wallet addresses, transaction volumes, or staking activity often support upward momentum, signaling deeper network engagement.

“In evaluating Jasmy price movements, investors need to separate short-term hype from real adoption metrics. Look beyond price charts to network growth and developer activity for a clearer view of true value,” says Dr. Hanae Matsumoto, blockchain analyst at Tokyo Institute of Technology.

Beyond these, macroeconomic events—such as changes in global regulatory frameworks, crypto tax adjustments in Japan, and overall risk appetite in digital assets—play a significant role in daily and long-term Jasmy price trends.

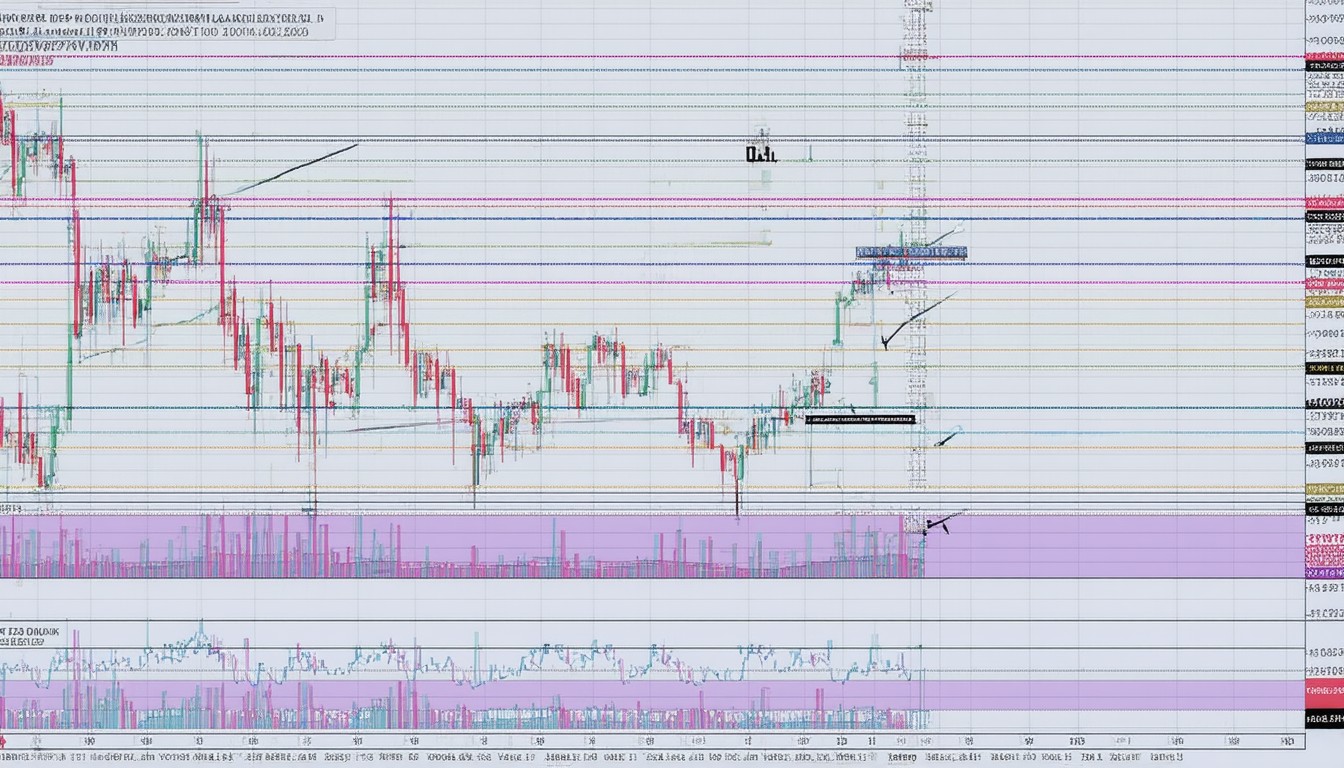

Market Trends: Technical Analysis of JasmyCoin

A closer technical analysis of JasmyCoin reveals recurring patterns common to young altcoins. Price surges tend to correlate with heightened ecosystem activity, but retracements often follow as speculative interest wanes.

Chart Patterns and Support Levels

- Volatility: Jasmy often sees double-digit percentage moves within short periods, particularly around announcements or major exchange listings.

- Support and Resistance: Technical analysts watch key support levels (historically, near major round numbers and previously established lows) to gauge downside risk, while identifying overhead resistance for potential upside.

- Long-Term Moving Averages: JasmyCoin’s 50-day and 200-day moving averages offer traders signals for trend reversals or periods of consolidation.

Investor Scenarios

For example, when Jasmy was listed on a major global exchange, its price nearly doubled within days before correcting as early profit-takers exited. Conversely, periods of low activity have seen Jasmy drift sideways, underscoring the influence of news and liquidity over its live value.

Jasmy and Industry Adoption: Real-World Use Cases

Jasmy’s utility extends beyond speculation, as companies leverage its blockchain for secure IoT and data transactions. Industry adoption remains a core determinant of long-term price appreciation.

Noteworthy Applications

- Automotive Data Sharing: Car manufacturers use Jasmy’s infrastructure to allow vehicle owners to monetize driving and maintenance data securely.

- Smart Factories: Japanese manufacturing firms have conducted pilot projects utilizing Jasmy’s network for machine-to-machine data exchange in supply chain management.

While these examples are promising, real impact on Jasmy’s price depends on scaling such use cases globally and driving consistent demand for the JASMY token.

Risks, Opportunities, and Outlook

Like many young cryptocurrencies, investing in Jasmy comes with pronounced risks—but also unique opportunities as the IoT sector expands.

Key Risks

- Regulatory Shifts: Changes to crypto regulation in Japan or worldwide could impact Jasmy’s business model or its exchange listings.

- Competition: Rapid innovation in blockchain-based IoT and data privacy could challenge Jasmy’s market share if rival protocols gain traction.

- Volatility: Short-term price swings may dissuade risk-averse buyers or those seeking stable returns.

Opportunities

- Expanding Partnerships: Continued collaboration with Japanese and international firms could accelerate real-world adoption.

- Growing Demand for Data Sovereignty: With data security and user privacy at the forefront of technology trends, Jasmy’s focus aligns well with emerging policy and business priorities.

Conclusion: Strategic Insights for JasmyCoin Watchers

JasmyCoin sits at the intersection of the IoT revolution and blockchain innovation, offering a compelling story for both tech enthusiasts and financial speculators. While its price continues to reflect a volatile early-stage market, underlying technological advancements and partnerships suggest a potential for sustained relevance. Investors and observers should monitor not only the live Jasmy price but also broader adoption metrics and regulatory developments driving long-term value.

FAQs

What is JasmyCoin’s primary use case?

JasmyCoin is used to enable secure, decentralized data sharing between individuals and organizations, particularly within IoT networks. Users can earn JASMY tokens by sharing personal or device data with approved companies.

Why does Jasmy price fluctuate so much?

The Jasmy price is influenced by market sentiment, limited liquidity, and speculative trading. Sudden news, regulatory changes, or new exchange listings can all trigger rapid price movements.

How does Jasmy differ from other IoT-focused cryptocurrencies?

Jasmy distinguishes itself through its regulatory compliance in Japan and strong industry ties, especially in the automotive sector. Its focus on user-controlled data and enterprise applications sets it apart from competitors.

Is JasmyCoin available on major exchanges?

Yes, JasmyCoin is listed on several leading cryptocurrency exchanges, though availability can vary by region and regulatory conditions. Access to large exchanges enhances visibility and trading volume.

What are the main risks of investing in Jasmy?

Key risks include regulatory changes, competition in the IoT/blockchain sector, and the inherent volatility of new digital assets. Investors should be cautious and conduct thorough research before participating.

Does Jasmy have potential for long-term growth?

The potential for growth depends on the ongoing adoption of its technology by industry partners and the broader acceptance of blockchain-based data solutions. Monitoring network activity and industry developments is essential for assessing long-term promise.

Established author with demonstrable expertise and years of professional writing experience. Background includes formal journalism training and collaboration with reputable organizations. Upholds strict editorial standards and fact-based reporting.