Hbar

HBAR Price: Live Chart, Market Analysis & Latest Hedera Updates

As the cryptocurrency market continues its rapid evolution, Hedera’s native token, HBAR, stands out for its blend of enterprise-grade utility and distinctive consensus mechanism. While coins like Bitcoin and Ethereum capture headlines, HBAR has steadily cultivated a robust ecosystem focused on real-world applications, sustainable performance, and institutional partnerships. Against this backdrop, understanding the dynamics shaping HBAR’s price is increasingly relevant for investors, developers, and observers of the digital asset space.

Real-Time HBAR Price Overview

The price of HBAR reflects a confluence of technological progress, ecosystem developments, and broader market sentiment. Like many digital assets, HBAR’s price exhibits volatility—affected as much by macroeconomic trends as by blockchain-specific news and innovations.

- 24-hour trading range: HBAR can fluctuate significantly within a day, particularly during periods of heightened market activity or news releases.

- Liquidity and exchanges: HBAR is available on major platforms such as Binance, Coinbase, and Kraken, ensuring deep liquidity and ease of access for global users.

- Market cap position: While it doesn’t rival Bitcoin or Ethereum in size, HBAR routinely ranks among the top cryptocurrencies by market capitalization.

Beyond these headline figures, day-to-day movements in HBAR’s price are shaped by factors unique to the Hedera network.

Key Drivers of HBAR Price Movement

Several core elements underpin HBAR’s price trajectory. These include technical advancements, institutional engagement, ecosystem growth, and broader industry trends.

Technological Foundations and Consensus Innovation

Hedera’s utilization of the hashgraph consensus protocol distinguishes it from conventional blockchains. Unlike proof-of-work or proof-of-stake models, hashgraph promises asynchronous Byzantine Fault Tolerance (aBFT), high throughput, and low-latency finality.

This technical advantage translates to:

- Fast transaction speeds: HBAR’s network processes thousands of transactions per second (TPS), serving real-world payment and data use cases.

- Low, predictable fees: Transaction costs on Hedera remain stable, a key attractor for enterprises seeking scalable blockchain solutions.

- Carbon-negative operations: Hedera has committed to sustainability, offsetting its energy footprint, which increasingly appeals to ESG-conscious investors.

“Hashgraph’s efficiency and security have drawn interest from large enterprises and developers alike, setting HBAR apart in a crowded marketplace,” says Vignesh Sundaresan, blockchain investor and founder of Metapurse.

Ecosystem Partnerships and Enterprise Adoption

What further differentiates HBAR is the high-profile composition of the Hedera Governing Council—an alliance of global corporations such as Google, IBM, LG, and Standard Bank. Each member operates network nodes and contributes strategic oversight, helping to instill trust and drive adoption.

Key impacts on price include:

- Enterprise deployments: When council members launch applications or announce integrations, HBAR often experiences price surges, signaling investor confidence in enterprise validation.

- Council expansion: New additions often precede increases in price and media attention, indicating broader institutional support.

Market Sentiment, Speculation, and Macro Trends

Like all digital assets, HBAR’s price is susceptible to shifts in risk appetite, regulatory announcements, and macroeconomic shocks. During bull cycles, speculative interest can drive rapid appreciation; conversely, broader downturns can see HBAR retrace gains alongside the broader market.

Complicating the picture is the fixed supply model—HBAR is capped at 50 billion tokens, with staggered releases impacting circulating supply and, by extension, price.

HBAR Price Performance: Historical Trends

Examining HBAR’s historical price action helps contextualize its present standing and potential pathways ahead.

Notable Milestones and Corrections

- Initial launch: HBAR debuted on exchanges in 2019, initially traded at cents per token, with volatile movement as the market reacted to the project’s public rollout.

- 2021 surge: The broader crypto bull run, coupled with growing institutional involvement in the Hedera Governing Council, pushed HBAR to all-time highs. Many observers cited network upgrades and new use cases as catalysts.

- Bear market resilience: Like the larger altcoin universe, HBAR corrected during bearish phases. Still, its price relative to initial offerings has generally trended upward, demonstrating resilience rooted in fundamental utility.

Lessons from the Past

Volatility remains a hallmark of HBAR’s trading history. Strategic investors track key development milestones and council activity as indicators of future momentum.

Comparison with Other Layer 1 Tokens

In contrast to Layer 1 tokens like Solana (SOL), Cardano (ADA), or Algorand (ALGO), HBAR pursues both speed and environmental sustainability. Its focus on permissioned governance and enterprise-grade functionality appeals to a distinctive market segment.

Latest Hedera Updates and Ecosystem Developments

Staying informed about recent updates to Hedera provides crucial context for interpreting HBAR’s price movement and future prospects.

Technical Roadmap and Network Upgrades

Hedera’s team regularly delivers enhancements to network throughput, smart contract capabilities, and security features. Recent milestones include:

- EVM compatibility: Integrating with the Ethereum Virtual Machine broadens developer appeal and multiplies cross-chain use cases.

- Tokenization framework: Improved support for NFTs and fungible tokens has spurred activity in decentralized applications (dApps) and decentralized finance (DeFi).

Real-World Deployments: Case Studies

Several council members have leveraged Hedera for in-production solutions:

- Avery Dennison: The supply chain giant uses Hedera to track product provenance.

- Shinhan Bank: This South Korean institution pilots cross-border payment solutions using HBAR.

- LG Electronics: Explores digital identity verification via the network.

These deployments increase on-chain activity, often boosting demand for HBAR tokens.

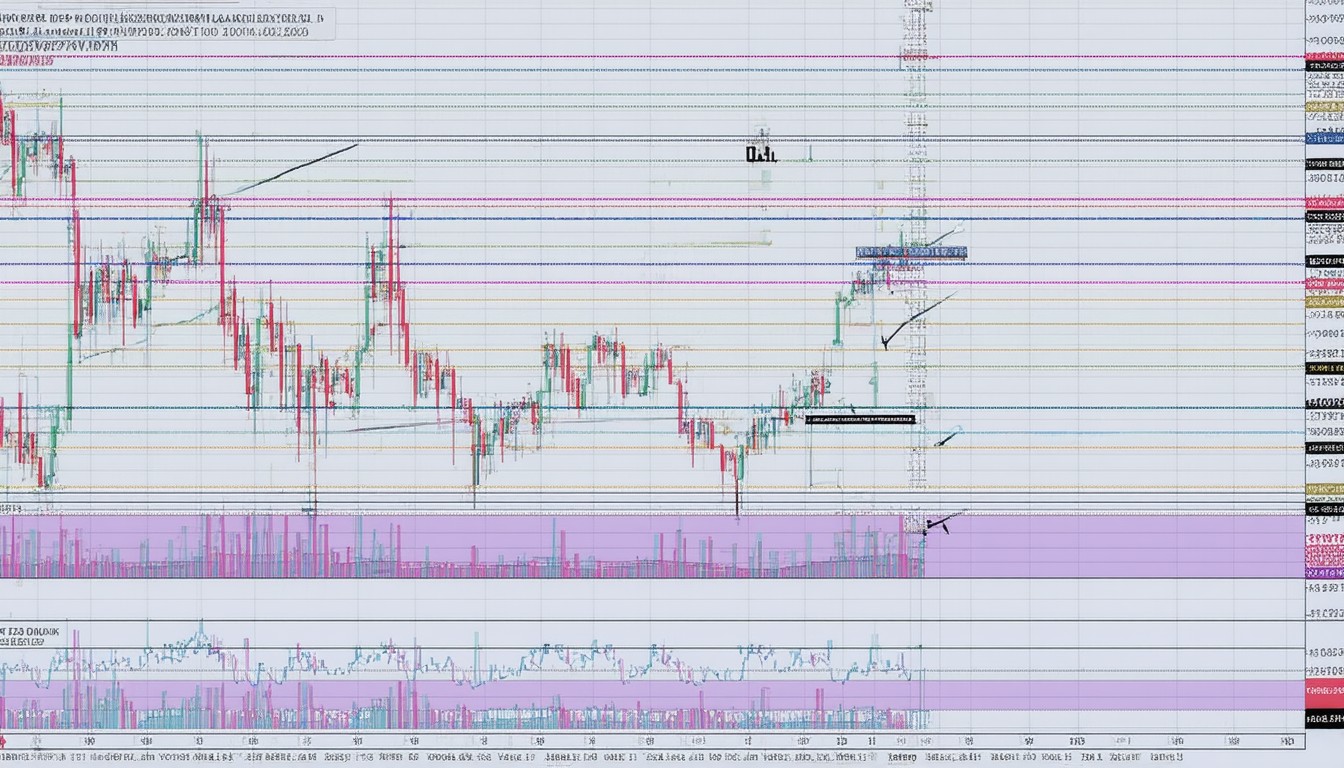

Technical Analysis: Chart Patterns and Indicators

While fundamentals guide long-term outlook, technical analysis offers tactical insight for traders researching HBAR price.

Key Indicators

- Relative Strength Index (RSI): Used to identify overbought or oversold conditions.

- Moving Averages (MA): 50-day and 200-day averages highlight long-term momentum shifts.

- Support and resistance levels: Chartists pay attention to historical price ceilings and floors for trade planning.

Chart Patterns to Watch

- Breakouts: Periods of consolidation followed by high-volume moves may signal new price trends.

- Reversal signals: Candlestick patterns and divergence indicators can offer early warnings of trend changes.

It’s important to remember that technical signals, while useful, should always be interpreted alongside project news and market fundamentals.

Risks and Considerations for HBAR Investors

No digital asset is without risk, and HBAR is no exception. Key considerations include:

- Regulatory uncertainty: While Hedera’s council is global, shifting laws can impact token utility and exchange listings.

- Token supply schedule: Vesting and token unlock events can introduce short-term selling pressure.

- Competitive landscape: The blockchain sector is highly dynamic, with new protocols emerging regularly.

Investors are advised to conduct thorough due diligence and consider broader portfolio diversification.

Conclusion: Strategic Outlook for HBAR

The trajectory of HBAR price reflects more than typical market swings; it’s shaped by ongoing enterprise adoption, technical evolution, and credible governance. While volatility may persist in the near term, Hedera’s clear focus on real-world use cases and its ability to attract global partners position it uniquely among Layer 1 projects. For those evaluating long-term digital asset opportunities, HBAR warrants close attention.

FAQs

What factors most influence HBAR’s price?

HBAR’s price responds to network developments, enterprise partnerships, user adoption, and overall crypto market sentiment. Token supply events and updates from Hedera’s Governing Council are particularly influential.

How can I track the live HBAR price reliably?

Reputable platforms such as Binance, Coinbase, and CoinMarketCap provide real-time HBAR price data. These services aggregate prices across multiple exchanges for comprehensive tracking.

Is HBAR a sustainable cryptocurrency?

Hedera has committed to offsetting its carbon emissions and operates a highly energy-efficient network. This has positioned HBAR as an environmentally conscious option compared to many legacy blockchains.

What role do governing council members play in HBAR’s value?

Governing council members help shape the network’s technical and strategic direction, often driving real-world applications and adding credibility. New partnerships or product launches from these enterprises can affect HBAR’s perceived value.

Is technical analysis effective for trading HBAR?

Many traders use chart patterns, moving averages, and other technical tools to assess HBAR price trends. However, combining technical analysis with awareness of news and ecosystem developments provides a fuller picture for decision-making.

Established author with demonstrable expertise and years of professional writing experience. Background includes formal journalism training and collaboration with reputable organizations. Upholds strict editorial standards and fact-based reporting.