Fomc

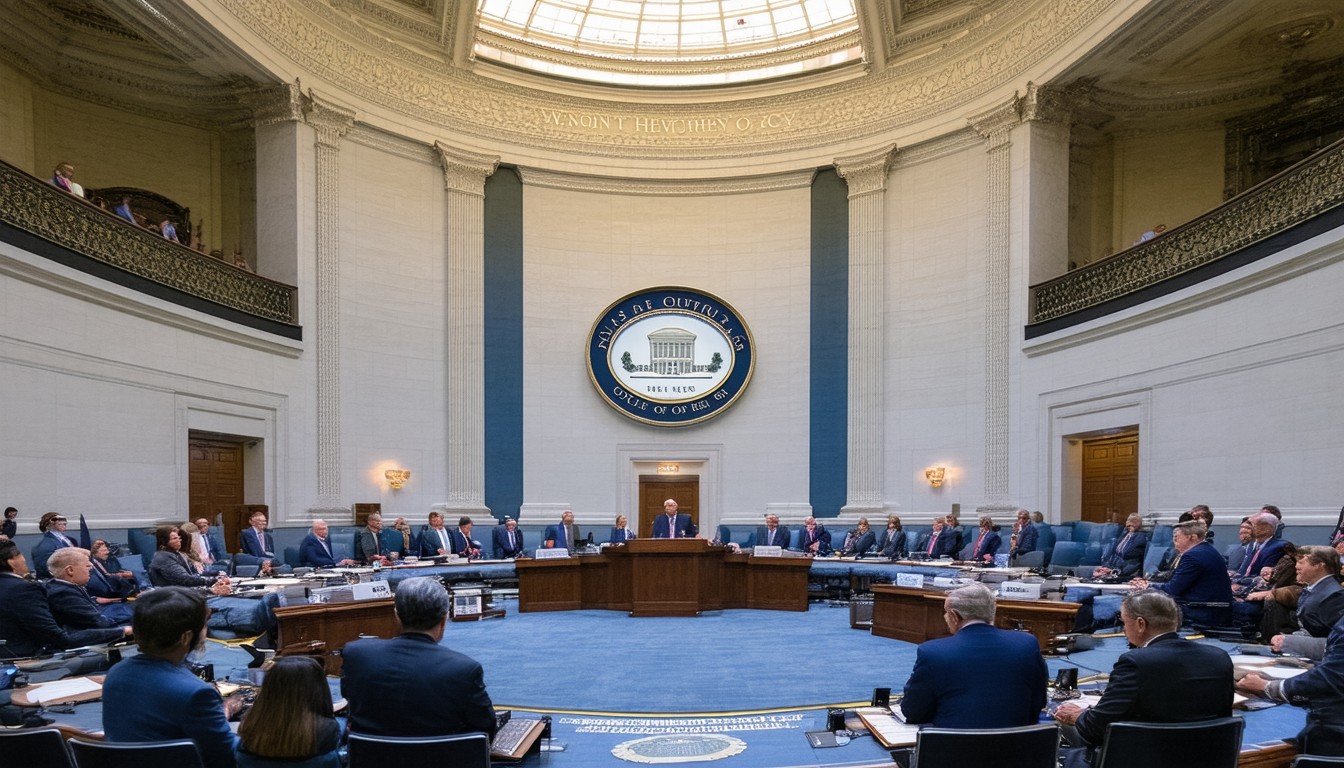

FOMC Meeting Highlights: Key Policy Decisions and Market Impact

Few events in global finance command as much attention as the policy meetings of the Federal Open Market Committee (FOMC). As the body within the Federal Reserve responsible for setting key monetary policy decisions—including the federal funds rate—the FOMC’s statements and actions ripple across economies and financial markets worldwide. These meetings, held regularly throughout the year, are closely scrutinized by investors, policymakers, and the public for signals about the direction of interest rates, inflation, and economic growth.

Recent volatility in financial markets and persistent macroeconomic challenges have amplified the stakes of each FOMC meeting. Through open market operations, rate adjustments, and economic outlooks, the Committee influences not only U.S. capital markets but also shapes expectations across currencies, commodities, and global risk sentiment. Understanding the highlights of each FOMC meeting offers a blueprint for interpreting broader trends in the U.S. and world economies.

Overview of FOMC Structure and Mandate

The FOMC comprises 12 voting members: the seven members of the Federal Reserve Board of Governors and five of the twelve Reserve Bank presidents who serve on a rotating basis. Its primary goals, known as the dual mandate, are to foster maximum employment and stable prices. This means the Committee must continually weigh the risks of inflation against the dangers of a slowing economy or rising unemployment.

Meetings typically occur every six to eight weeks, culminating in a public statement that summarizes the Committee’s policy decisions and rationale. These communiqués have evolved to become more transparent, providing forward guidance about likely future moves in monetary policy.

How Decisions Are Made

- Voting and Debate: Each member brings regional and national perspectives to the table. Discussions involve analysis of economic data, projections for inflation, employment, and GDP.

- Policy Tools: The FOMC primarily adjusts the federal funds rate, but can also modify quantitative easing programs, adjust the discount rate, and alter communication strategies.

- Economic Projections: Periodically, the FOMC publishes the Summary of Economic Projections (SEP), offering insight into its collective outlook.

Latest FOMC Meeting Highlights: Key Policy Decisions

The most recent FOMC meeting continued the Committee’s cautious approach as it navigates a complex economic backdrop defined by sticky inflation, an uneven labor market, and geopolitical uncertainties.

1. Federal Funds Rate: On Hold, With a Hawkish Tilt

For several consecutive meetings, the FOMC has opted to keep the federal funds rate unchanged, maintaining it at a multi-year high. This policy stance reflects ongoing concerns about persistent core inflation—even as headline price growth has moderated somewhat. FOMC members have reiterated their commitment to a data-dependent approach, indicating that rate cuts are unlikely until inflation demonstrates sustained progress toward the 2% target.

“The Committee is maintaining its restrictive policy stance due to strong consumer demand and labor market resilience, but remains prepared to adjust if economic conditions change materially,” said a senior Federal Reserve official.

2. Inflation Outlook: Risks Remain Elevated

Despite some cooling in price increases, FOMC meeting minutes and subsequent press conferences have highlighted that inflation risks remain skewed to the upside. Factors such as services inflation, housing costs, and global supply chain disruptions have proven more stubborn than anticipated. Market participants now expect a slower trajectory for potential rate reductions.

3. Employment and Growth: Mixed Signals

The Committee noted ongoing strength in aggregate employment, with unemployment hovering near historic lows. However, recent data suggest that job creation may be plateauing, raising questions about how much labor market slack exists. Meanwhile, GDP growth remains positive but has softened compared to the post-pandemic rebound.

4. Forward Guidance and Market Communication

The FOMC’s carefully crafted language continues to set expectations not just for policy changes, but also for the conditions that would prompt them. By emphasizing a high threshold for easing, the Fed aims to anchor inflation expectations and prevent premature market rallies.

Market Impact: Equities, Bonds, and Beyond

Reactions to FOMC meetings are swift and broad-based, moving not only U.S. stocks and bonds but also impacting global assets.

Equities: Volatile But Resilient

Following recent meetings, equity markets have exhibited high volatility as investors digest both the Fed’s cautious stance and potential windows for rate easing. Growth stocks, particularly in technology, have proven sensitive to shifts in rate expectations, whereas value stocks and defensives have at times benefited from more hawkish messaging.

Bond Markets: Yield Curve Dynamics

Treasury yields, most notably in short- and intermediate-dated securities, often surge on evidence that the FOMC is in no rush to cut rates. The yield curve—already inverted in many maturities—remains a focus for recession watchers and strategists.

Currencies and Commodities: Dollar Strength and Global Flows

The FOMC’s stance has kept the U.S. dollar robust against major global currencies, as higher relative yields attract capital inflows. This, in turn, pressures commodities priced in dollars and has knock-on effects for emerging markets grappling with capital flight and rising borrowing costs.

Real-World Context: How the FOMC’s Decisions Intersect with Everyday Life

FOMC actions reach far beyond Wall Street. Borrowers, savers, and business leaders all contend with the ripple effects of policy shifts. For instance:

- Borrowing Costs: Mortgage rates and consumer loans remain elevated, dampening housing activity and big-ticket purchases.

- Corporate Investment: Uncertainty about future rates encourages caution among business leaders, potentially slowing hiring and capital expenditures.

- Household Budgets: While inflation has moderated, many essential costs, like shelter and services, still outpace wage growth for some households.

Expert Perspectives: Interpreting the Broader Implications

Monetary policy experts continue to stress the delicacy of the Fed’s current position. While the fight against inflation is ongoing, an overly aggressive stance risks stifling growth. Conversely, loosening too early could spark another inflationary cycle.

“Monetary policy is a balancing act between patience and responsiveness. The FOMC’s credibility hinges on its ability to thread this needle without surprising markets or derailing the recovery,” emphasizes Dr. Linda Carpenter, professor of economics and noted Fed-watcher.

The Road Ahead: What to Watch for After the Most Recent Meeting

Financial markets, analysts, and the public remain laser-focused on incoming data—especially on inflation, employment, and consumer spending. Future FOMC meetings are expected to maintain a “higher-for-longer” bias until clear evidence emerges that inflation is under consistent control. Any signs of labor market weakness or escalating global risks could compel a pivot, so vigilance is warranted.

Conclusion: Decoding the FOMC’s Signals for Strategic Decisions

FOMC meetings serve as the compass for U.S. and global monetary policy. The Committee’s latest decisions underscore its commitment to anchoring inflation while remaining attuned to evolving risks. For investors, businesses, and households, prudent navigation hinges on staying attuned to FOMC signals and the economic data that shape them. As the Fed’s path forward remains data-dependent, flexibility and a close eye on market and economic trends are paramount.

FAQs

What is the FOMC and why are its meetings important?

The FOMC, or Federal Open Market Committee, is the policy-setting body of the U.S. Federal Reserve. Its meetings shape the direction of interest rates and monetary policy, profoundly influencing markets, the economy, and borrowing costs.

How often does the FOMC meet?

The FOMC typically convenes eight times per year, though additional emergency meetings can be called as needed to address rapid economic shifts or crises.

How do FOMC decisions impact everyday people?

Decisions from FOMC meetings affect interest rates on mortgages, loans, and savings accounts. Changes in monetary policy can also impact inflation, job growth, and overall economic stability.

What are some key indicators that the FOMC watches?

The Committee closely monitors inflation rates, labor market statistics, GDP growth, and various global economic signals. These data points guide decisions on whether to tighten or loosen policy.

How quickly do markets react to FOMC announcements?

Markets typically respond within minutes of FOMC statements being released, adjusting stock prices, bond yields, and currency values based on perceived policy direction.

Where can the public find FOMC meeting statements?

All official FOMC statements, minutes, and projections are published on the Federal Reserve’s website, providing transparency for analysts and the public alike.

Experienced journalist with credentials in specialized reporting and content analysis. Background includes work with accredited news organizations and industry publications. Prioritizes accuracy, ethical reporting, and reader trust.