Eth

Ethereum ETH: Live Price, Chart, Market Cap & Latest Updates

Ethereum (ETH) continues to shape the digital asset landscape, not only as a foundational blockchain for decentralized applications (dApps) and smart contracts, but also as one of the most actively traded cryptocurrencies worldwide. Since its launch in 2015, Ethereum has steadily evolved from a promising protocol into a critical pillar for both decentralized finance (DeFi) and non-fungible tokens (NFTs). The network’s ongoing upgrades, community activity, and price volatility make it a focal point for investors, developers, and market analysts alike.

With institutional adoption accelerating and new technical developments unfolding, understanding Ethereum’s current price, market capitalization, historical trends, and recent updates is essential for anyone navigating the crypto economy.

Ethereum ETH: Live Price and Market Capitalization Trends

Price Volatility and Catalysts

ETH’s price fluctuates dynamically, influenced by market sentiment, macroeconomic events, protocol developments, and broader cryptocurrency trends. Major milestones—like the transition from proof-of-work (PoW) to proof-of-stake (PoS) with the 2022 “Merge”—have historically triggered significant movements in Ethereum’s price.

For context, ETH has experienced cycles of bull runs and corrections, reaching all-time highs following surges in both retail and institutional interest. According to data from CoinMarketCap and other aggregators, Ethereum consistently ranks as the second-largest cryptocurrency by market capitalization, commanding a substantial share of global trading volume.

Key Drivers Affecting ETH Price

- DeFi Activity: The expansion of decentralized finance platforms directly boosts demand for ETH, as it’s frequently used for collateral, staking, and transaction fees.

- NFT Market Growth: Each NFT minted or traded on Ethereum generates network activity and requires ETH for transaction fees (“gas”).

- Network Upgrades: Improvements—such as EIPs (Ethereum Improvement Proposals) and scaling solutions—can impact price expectations by enhancing usability and reducing fees.

- Regulatory Developments: Shifts in regulatory sentiment can create rapid price swings, as seen in response to SEC communications or global financial policy updates.

Market Cap: Measuring Broader Impact

Ethereum’s market capitalization, calculated by multiplying its circulating supply by current price, reflects its overall economic significance. Even amidst volatility, Ethereum’s sustained market cap growth underscores its adoption across DeFi, NFTs, and enterprise blockchain projects.

“Ethereum’s market cap isn’t just a number—it’s a signal of the collective confidence in its role as Web3 infrastructure,” notes blockchain analyst Jamie Lee. “Sustained market cap growth highlights how core Ethereum has become in digital economies.”

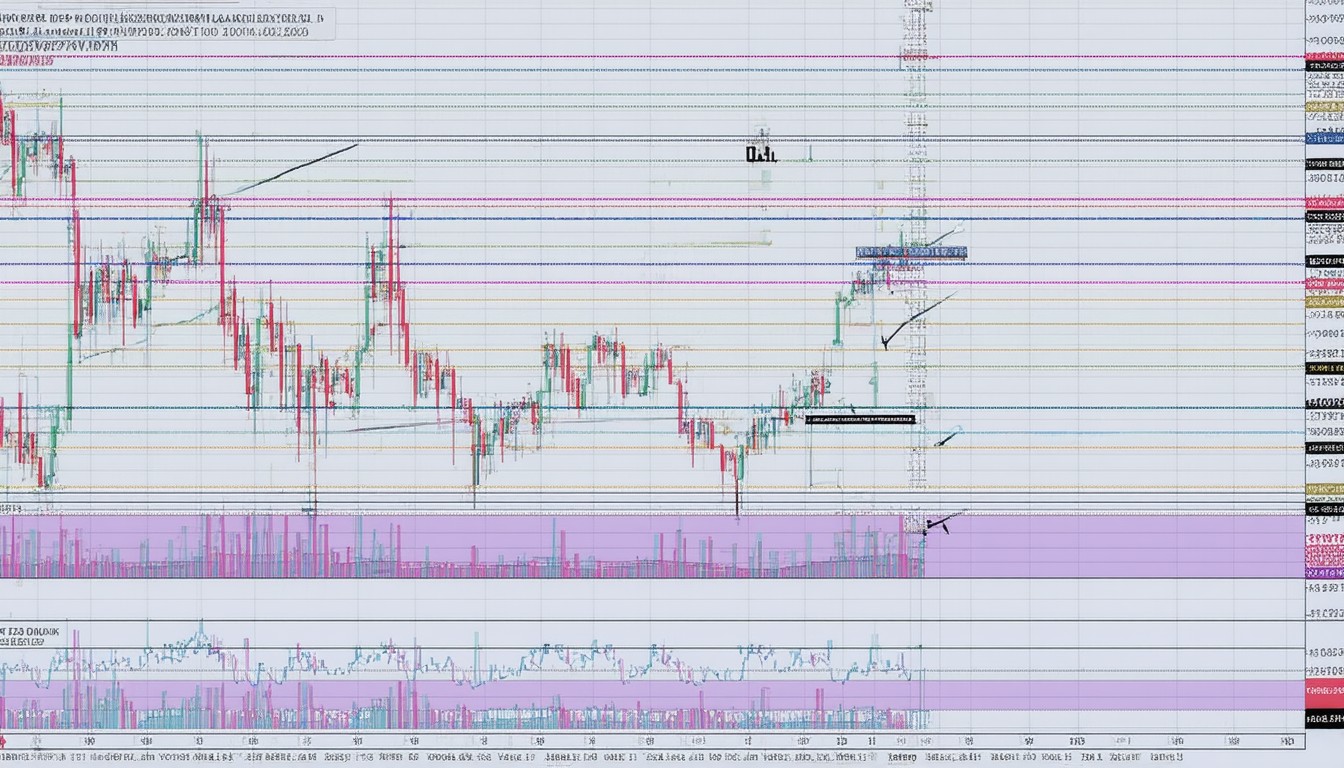

Real-Time Chart Analysis: Navigating Trends and Patterns

Live ETH price charts provide actionable insights for traders and long-term holders. Charting platforms offer a range of tools—moving averages, RSI, Fibonacci retracements—to identify potential entry and exit points.

- Short-Term Analysis: Intraday charts often reveal high volatility, with price swings driven by news, on-chain activity spikes, and large trades.

- Long-Term Trends: Multi-month or yearly charts have shown periods of consolidation, uptrends punctuated by market-wide corrections, and parabolic rallies particularly during major upgrade announcements.

For example, prior to the Merge in 2022, ETH’s price appreciated notably as anticipation around the shift to PoS mounted. However, like other digital assets, it remains sensitive to macroeconomic shifts such as changes in US monetary policy or global risk appetite.

Recent Upgrades and Ecosystem Developments

The Impact of The Merge

The Merge marked Ethereum’s most significant upgrade to date, transitioning the chain from energy-intensive proof-of-work to an environmentally sustainable proof-of-stake consensus mechanism. This shift drastically reduced the network’s energy usage and set the foundation for future scalability improvements.

Benefits and Trade-offs

- Energy Consumption: Post-Merge, Ethereum’s energy footprint is estimated to have dropped by over 99%, making it far more attractive to ESG-focused investors.

- Staking Rewards: ETH holders can now participate in network security and earn rewards by staking their tokens.

- Decentralization Concerns: Some critics argue that proof-of-stake could concentrate influence among larger holders, a point of continuous discussion in the Ethereum community.

Upcoming Protocol Enhancements

Ethereum’s roadmap includes further scaling upgrades—most notably danksharding and increased rollup efficiency—which are expected to reduce transaction fees and enable mass adoption. Layer 2 solutions, such as Optimism and Arbitrum, are already handling a significant share of transactions off-chain, greatly improving throughput.

Beyond the technical sphere, Ethereum continues to see robust growth across sectors:

– Enterprise Adoption: Major firms like JP Morgan and Microsoft have experimented with Ethereum-based smart contracts and private chain variants.

– DeFi and NFTs: Despite market cycles, Ethereum remains the dominant platform for decentralized exchanges, lending protocols, and NFT marketplaces.

Market Sentiment and Institutional Perspectives

Investor sentiment around ETH has shifted noticeably as both traditional and crypto-native institutions have begun allocating to Ethereum or building products on its blockchain.

Institutional Entry

After the Merge reduced ESG concerns, hedge funds, asset managers, and even pension funds have grown more comfortable considering ETH as a portfolio asset. In parallel, the development of regulated ETH-based investment products—such as ETPs (exchange-traded products) and futures—has widened access for mainstream investors.

Community Governance and Decentralization

Ethereum’s governance remains a unique blend of developer coordination, token-holder input, and open community discourse. Unlike traditional financial assets, protocol decisions and upgrades are debated transparently, involving a diverse and often passionate set of stakeholders.

Navigating Risks and Opportunities

Key Risks

- Scalability Bottlenecks: Until full scaling (e.g., via sharding) arrives, congestion and high gas fees may persist during peak activity.

- Regulatory Uncertainty: Ethereum’s classification as a security (or not) remains under global regulatory scrutiny, which can influence both price and utility.

- Smart Contract Vulnerabilities: The open nature of dApp development means that code exploits—though less frequent as standards improve—can still pose systemic risks.

Long-Term Opportunities

- Programmablility: Ethereum’s programmable nature underpins thousands of innovative projects, from decentralized autonomous organizations (DAOs) to blockchain-based gaming.

- Interoperability: Bridges to other blockchains and cross-chain protocols are expanding Ethereum’s ecosystem influence.

- Store of Value + Utility: Unlike Bitcoin, ETH combines potential as a store-of-value asset with unique utility as “fuel” for decentralized applications.

Conclusion: Ethereum ETH’s Evolving Role

Ethereum (ETH) occupies a pivotal and evolving space in the cryptocurrency and blockchain ecosystem. Its blend of technical innovation, community-driven governance, and robust adoption across DeFi and NFTs points toward lasting relevance—even as it navigates significant competitive and regulatory headwinds.

Staying informed about live price movements, chart patterns, and the ongoing evolution of Ethereum’s protocol is essential for anyone engaging with the digital assets market. As the ecosystem matures, Ethereum’s ability to scale, innovate, and adapt will define its long-term legacy.

FAQs

What is the current price of Ethereum (ETH)?

ETH’s price fluctuates constantly and can be tracked on major crypto exchanges and aggregation platforms, offering real-time updates for traders and investors.

How does Ethereum differ from Bitcoin?

While both are blockchains, Ethereum is designed for programmability, supporting smart contracts and dApps, whereas Bitcoin primarily serves as a decentralized digital currency.

What are Ethereum gas fees and why do they matter?

Gas fees are payments required to process transactions or execute smart contracts on Ethereum; they fluctuate based on network demand and impact user costs, especially during periods of congestion.

Is Ethereum environmentally friendly after the Merge?

Yes, Ethereum’s transition to proof-of-stake has drastically lowered its energy consumption, addressing many environmental concerns previously associated with blockchains.

Can I earn rewards by staking ETH?

ETH holders can stake their assets to support network security and consensus, earning rewards in return—a process enabled by the proof-of-stake mechanism.

What risks are associated with investing in Ethereum?

Risks include price volatility, potential smart contract exploits, regulatory developments, and ongoing technical challenges related to scaling and security. Staying informed and conducting due diligence is key.

Established author with demonstrable expertise and years of professional writing experience. Background includes formal journalism training and collaboration with reputable organizations. Upholds strict editorial standards and fact-based reporting.