Eth

ETH Price: Live Ethereum Value, Market Trends & Analysis

Ethereum’s native asset, ETH, is much more than a simple cryptocurrency. As the backbone of decentralized finance (DeFi), NFT platforms, and countless blockchain applications, ETH’s price movements command global attention from retail investors, institutions, and developers alike. However, the real-time value of ETH is shaped by a unique interplay of market sentiment, macroeconomic trends, technical upgrades, and shifting regulatory attitudes. Understanding these forces—and the technical and fundamental indicators cycled by industry insiders—can offer valuable insight into both short-term volatility and long-term growth prospects for ETH.

The Current Ethereum Value: Live Data and Influencing Factors

Live tracking of the ETH price is now a staple for investors. Visualization platforms such as CoinGecko, CoinMarketCap, and leading exchanges provide second-by-second updates. Beyond the basic USD, traders often watch ETH relative to BTC, euro, and major stablecoins, revealing divergence or convergence trends.

Several interconnected factors influence Ethereum’s real-time price:

- Market Liquidity: High trading volumes often amplify price swings, particularly during periods of news-driven sentiment or macro shocks.

- Network Activity: Metrics such as daily transactions, gas fees, and the Total Value Locked (TVL) in DeFi protocols are closely watched as barometers of Ethereum’s utility.

- Protocol Upgrades: Major events like the Merge (Ethereum’s shift from proof-of-work to proof-of-stake) have historically generated volatility, as participants speculate on upgrades’ impacts.

- External Macro Factors: Movements in the U.S. dollar, regulatory shifts in major economies, or sudden adversities impacting global risk appetite can all create sharp ETH price fluctuations.

“Ethereum price is more than just a number; it’s the nerve center reflecting innovation, adoption, and global risk sentiment converging in real time,” observes blockchain researcher Dr. Linda Cheng.

Key Historical Trends Shaping ETH Price

Milestones and Market Psychology

Since its 2015 launch, ETH’s price history has been punctuated by several landmark moments:

- 2017 ICO Boom: Ethereum powered the initial coin offering mania, propelling ETH from single-digit dollars to a then-unprecedented $1,400.

- Crypto Winters: Bear cycles following hype-driven peaks have seen ETH lose significant value—yet each new bull run sets higher long-term lows, underscoring resilient adoption.

- DeFi and NFT Summers: The 2020–2021 surge in DeFi protocols (such as Uniswap, Compound) and NFT platforms (OpenSea, Axie Infinity) drastically increased demand for ETH, as it became the “fuel” for blockchain innovation.

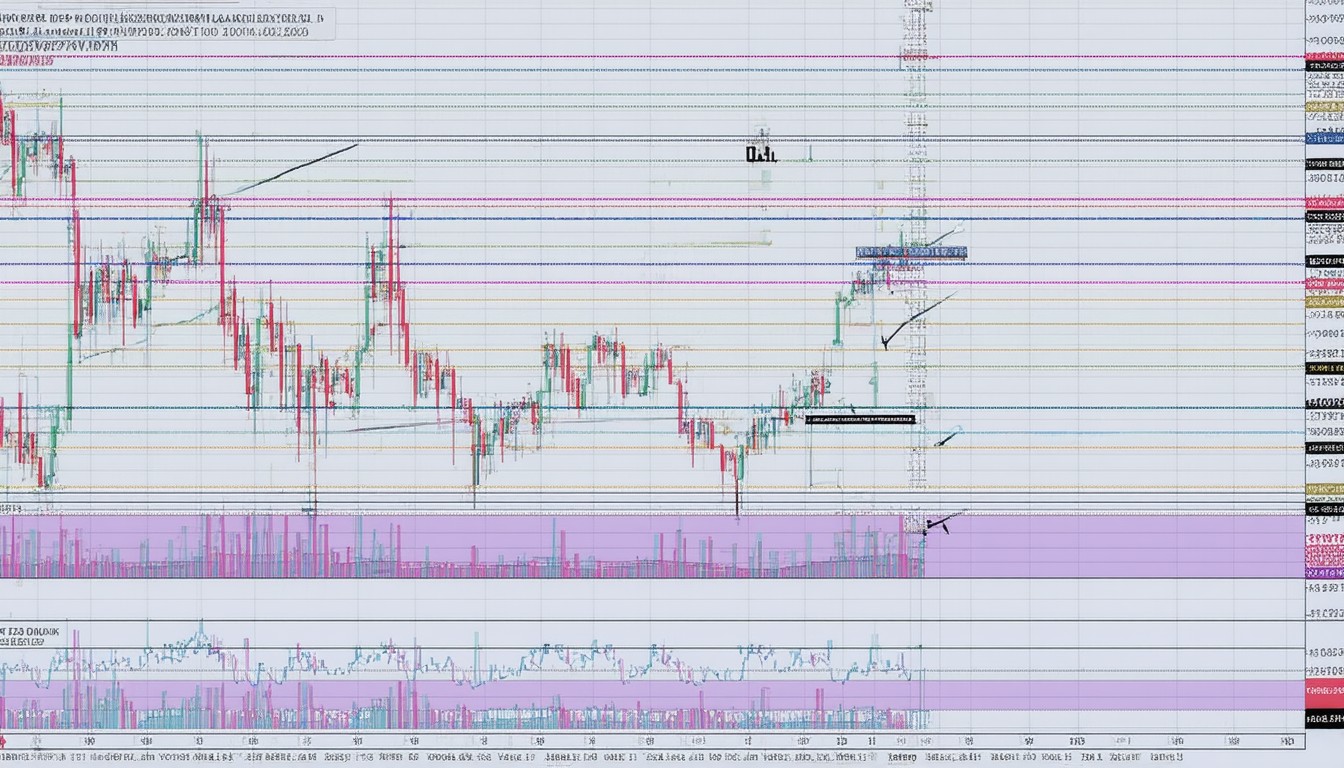

Technical Patterns and Cyclical Behavior

Professional traders analyze ETH price charts with tools like moving averages, Relative Strength Index (RSI), and Fibonacci retracement levels. Periods of consolidation often precede breakouts—sometimes triggered by external news, sometimes by organic network growth.

Ethereum’s price also tends to display seasonality—a phenomenon where certain months spur more volatility, often aligned with global fiscal cycles or major protocol updates.

Analyzing Recent Market Trends: 2023–2024

Institutional Interest and Maturing Liquidity

A pronounced development in recent years is the expanded participation of institutional players. With products such as Ethereum futures, spot ETF proposals, and custody solutions entering mainstream finance, ETH has achieved greater legitimacy and deeper liquidity. This institutionalization can both dampen and magnify volatility, depending on the scale and nature of market events.

In practice, for instance, ETF-related news cycles have regularly triggered double-digit intraday swings in ETH’s value. During positive regulatory catalysts, Ethereum’s price can rapidly outpace broader crypto benchmarks, fueled by speculative and hedging flows.

Correlation with Macro Assets

While once considered an uncorrelated asset, ETH now often trades in tandem with high-growth tech stocks, reacting to Federal Reserve policy announcements and inflation readings. This increased correlation means global economic health—and risk-on/risk-off sentiment—plays a growing role in Ethereum’s price trajectory.

The Impact of Layer-2 and Scaling Innovations

The advent of Ethereum layer-2 solutions (like Arbitrum and Optimism) and the rollouts of upgrades such as the Shanghai and Cancun forks have tangibly impacted ETH’s price. These technical innovations, aimed at scaling the network and reducing transaction costs, enhance Ethereum’s story as a utility asset for broader adoption. When such upgrades are successful, they tend to drive bullish price reactions, as market confidence in Ethereum’s technological roadmap is reinforced.

Forward-Looking Analysis: Technical and Fundamental Perspectives

Fundamental Analysis: Key Metrics to Watch

In assessing ETH’s future price potential, savvy observers watch a mix of on-chain and off-chain indicators:

- Total Value Locked (TVL): High levels in DeFi contracts signal sustained network activity and real-world application.

- ETH Burn Rate: Since EIP-1559, the network burns a portion of transaction fees, creating a deflationary effect potentially favorable for long-term price appreciation.

- Staking Dynamics: The volume of ETH staked on the Beacon Chain post-Merge represents a measure of ecosystem confidence and reduced liquid supply.

Technical Analysis: Support, Resistance, and Price Predictions

Traders commonly cite historical support levels near psychologically significant prices (e.g., $1,000, $2,000) and resistance bands at recent local highs. Crossovers in moving averages (such as the 50-day and 200-day) are often interpreted as directional cues. However, with crypto’s intrinsic volatility, all technical frameworks are best considered in context—combined with macro signals and real-world adoption trends.

Risks and Volatility: Important Considerations

Ethereum’s price can be affected by:

- Regulatory Actions: Sudden changes in government stance or legal interpretations

- Hacks and Smart Contract Failures: Exploits causing real loss of funds or a drop in user trust

- Competition from Other Blockchains: Rising utility or better scalability on alternative chains may dilute ETH’s share of network activity

Despite these risks, the strong developer ecosystem and continued innovation help underpin long-term optimism.

Conclusion: Navigating ETH Price with Informed Perspective

ETH’s price is a barometer of both technological progress and global investor sentiment. The interplay of on-chain dynamics, macroeconomic currents, and regulatory developments means real-time value is as much about narratives as numbers. For investors, traders, and observers, staying informed through reliable data, understanding technical patterns, and assessing fundamental network health are all crucial to navigating Ethereum’s ongoing evolution.

FAQs

What affects the price of ETH on a daily basis?

ETH price is primarily impacted by market liquidity, news events, network activity, and broader economic trends. Major protocol upgrades, shifts in regulatory outlook, and significant changes in investor sentiment can cause noticeable price swings.

How does Ethereum’s supply change impact its price?

Since the introduction of EIP-1559, a portion of transaction fees is burned, reducing overall ETH supply. This deflationary mechanism can support price appreciation, especially when demand is strong.

Why do Ethereum upgrades influence price so much?

Protocol upgrades, such as transitioning to proof-of-stake or introducing scaling solutions, can enhance Ethereum’s utility and security. These milestones often create optimism about the network’s future, prompting increased trading and volatility around the ETH price.

Is ETH still considered a good long-term investment?

Many analysts believe Ethereum’s ongoing innovation and adoption across DeFi and NFTs provide it with strong long-term potential. However, as with all crypto assets, ETH comes with significant risks and volatility.

How can I track live Ethereum prices accurately?

Reputable platforms like CoinMarketCap, CoinGecko, and leading crypto exchanges provide real-time ETH price data. For the most accurate tracking, use multiple sources and pay attention to both USD value and ETH’s performance against other major currencies.

What role do institutional investors play in ETH price movements?

Institutional participation has increased ETH’s market liquidity and mainstream acceptance. Their entry can both stabilize long-term prices and contribute to sharp short-term moves in response to news or regulatory developments.

Established author with demonstrable expertise and years of professional writing experience. Background includes formal journalism training and collaboration with reputable organizations. Upholds strict editorial standards and fact-based reporting.