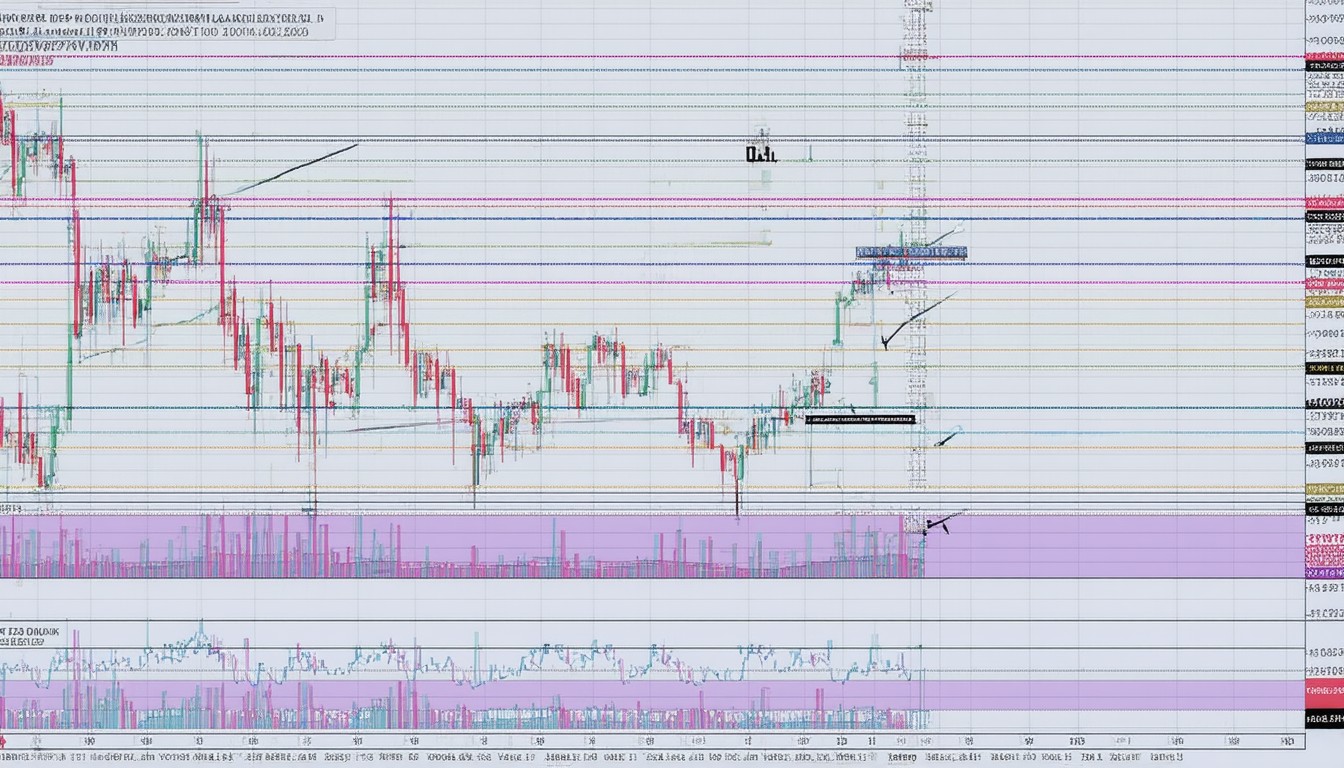

Chart

Pepe Coin Price | Live PEPE Value, Chart & Market Analysis

Track the live Pepe Coin price, explore historical data and expert technical analysis, and understand key trends shaping PEPE’s value. In-depth chart insights, FAQs, and professional market context.

Introduction: Pepe Coin’s Meteoric Rise and Market Relevance

The explosive surge of meme coins has transformed the digital asset landscape, and Pepe Coin (PEPE) now sits at the vanguard of this movement. Inspired by the viral Pepe the Frog meme, this token captured widespread attention shortly after its launch, experiencing unprecedented volatility reminiscent of Dogecoin and Shiba Inu. As speculation continues and new investors flock to this unpredictable market segment, the Pepe Coin price remains a focal point for traders, market analysts, and cultural commentators alike.

With the broader crypto market wrestling with regulatory shifts and recurring narratives around utility and hype, PEPE offers a unique case study in digital-era investment dynamics. Understanding Pepe Coin’s current live price, market cap, liquidity, and underlying sentiment is essential for anyone aiming to navigate its wild price swings and make informed decisions.

Live Pepe Coin Price: Real-Time Value and Chart Insights

Unlike legacy assets, meme coins are known for their rapid moves, often driven by social sentiment, trading hype, and viral moments. Pepe Coin exemplifies this volatility, with its price fluctuating considerably even within intraday periods.

Tracking the Pepe Coin Price

- Real-Time Price Feeds: Numerous platforms, such as CoinMarketCap, CoinGecko, and leading exchanges, stream the live price of PEPE. These aggregators provide charts showing minute-by-minute fluctuations, trading volume spikes, and liquidity metrics.

- Recent History: Following its debut, PEPE saw double-digit percentage gains and losses, with market cap frequently jumping or dipping in response to trending hashtags or celebrity tweets.

- Implied Volatility: For context, meme coins including PEPE tend to show higher volatility indexes than more established cryptocurrencies, reflecting a sensitive and speculative investor base.

This movement can be visualized in live charts, where Bollinger Bands, Relative Strength Index (RSI), and moving averages help traders identify potential breakout or reversal points. While short-term technicals are insightful, PEPE’s price often hinges on social media trends rather than fundamental news.

Market Analysis: Key Drivers Behind PEPE Value

Several interlinked factors shape the price of Pepe Coin, from market psychology to macro drivers.

Social Media & Community Hype

The PEPE brand leverages a vibrant, creative online community. Meme propagation through platforms like Twitter, TikTok, and Reddit acts as an accelerant for price momentum.

“In the case of PEPE, digital culture is inseparable from price action,” observes crypto analyst Sarah Liu. “A viral meme can ignite a buying frenzy just as swiftly as a negative headline can trigger panic selling.”

This reflexivity—price influencing memes, and memes influencing price—remains central to PEPE’s ongoing price action.

Exchange Listings and Liquidity

Announcement of new exchange listings regularly triggers upward spikes, as increased access begets fresh demand. When PEPE was listed on major centralized exchanges, liquidity deepened and trading volumes surged—attracting institutional-grade market makers and retail enthusiasts.

Broader Crypto Sentiment

General conditions across the cryptocurrency market, from Bitcoin price rallies to the flow of capital into “risk-on” altcoins, also impact PEPE. Should the overall sector experience a “bear” phase, retail appetite for meme coins like Pepe tends to diminish, leading to rapid price contractions.

Tokenomics and Supply

With hundreds of trillions of tokens in circulation, PEPE’s price per token stays visually low, encouraging retail participation. However, this vast supply also creates challenges for sustained upward movement, since sudden sales can exert disproportionate downward pressure.

Technical Analysis: Reading Pepe Coin’s Price Charts

Technical analysis remains popular among active PEPE traders, given the limited utility and unpredictable fundamentals.

Core Chart Patterns and Indicators

Technical traders lean on several classic tools when analyzing PEPE:

- Support & Resistance Levels: Identifying psychological price points where buyers or sellers consistently intervene.

- Moving Averages (MA): Short- and long-term MAs (e.g., 20-day, 50-day) often act as trend beacons.

- Volume Analysis: Spikes in trading volume can correlate with bull runs or impending corrections.

- Relative Strength Index (RSI): Overbought or oversold readings may predict short-term pullbacks or rallies.

Example Scenario: Volatility After a Viral Tweet

On occasions where a celebrity or influencer posts about PEPE, live price charts often exhibit a classic spike-and-retrace pattern. Within minutes of such events, buy volumes soar, only for the price to pull back as early entrants take profits.

Limitations of Chart-Based Strategies

While technical indicators provide a framework, they often take a back seat to meme-driven momentum. As a result, traders risk being whipsawed by unexpected news or viral trends with little connection to technical “setups.”

Comparing PEPE to Other Meme Coins and Cryptocurrencies

Pepe Coin is part of a growing category of speculative digital tokens—most notably Dogecoin (DOGE) and Shiba Inu (SHIB).

Similarities

- “All-In” Community Ethos: Like DOGE and SHIB, PEPE enjoys grassroots support and organizing power.

- Low Nominal Price: The per-token price is tiny, making large holdings psychologically appealing for retail traders.

Differences

- Central Narrative: While DOGE is seen as the original meme coin and SHIB as its “Ethereum-based” successor, PEPE has compounded meme layers—intertwining internet folklore with real-time trading.

- Tokenomics Approach: Differences in issuance, burn mechanisms, and development team involvement further differentiate PEPE from its predecessors.

Real-World Use and Utility

Unlike blue-chip cryptocurrencies that strive to solve payment or infrastructure challenges, meme coins like PEPE rarely promise utility beyond speculation. Some projects may announce NFT integrations or staking features, but these remain secondary to their primary cultural draw.

Risks and Considerations in Buying Pepe Coin

Engagement with PEPE comes with risks specific to meme coins:

- Extreme Volatility: Intraday price swings can wipe out or multiply positions rapidly.

- Lack of Fundamental Backing: Prices move with sentiment, not revenue or platform adoption.

- Project Longevity: Meme coins can fade as quickly as they rise if community interest wanes.

Savvy investors approach such markets with caution, proper risk controls, and awareness of broader crypto cycles.

Conclusion: Navigating the PEPE Craze with Informed Perspective

Pepe Coin’s price journey encapsulates the ethos and unpredictability of meme-driven crypto markets. For traders and observers alike, understanding PEPE requires a blend of technical chart-watching, real-time sentiment analysis, and a healthy skepticism for viral trends. While live price data and technical indicators offer valuable insights, the decisive factor remains the coin’s extraordinary resonance within online communities.

As the crypto landscape evolves—with new regulations, shifting narratives, and ever-changing cultural signals—Pepe Coin’s position at the intersection of internet culture and market speculation will continue to serve as both a warning and a fascination for the digital age.

FAQs

What is the all-time high price of Pepe Coin?

Pepe Coin reached its all-time high shortly after its launch, driven by intense trading activity and viral social media interest. The specific price fluctuates depending on the data provider, but it marked a peak during the initial meme frenzy.

Why does the Pepe Coin price change so rapidly?

The main drivers are high volatility, low token price per unit, and the meme coin’s reliance on social sentiment. News, influencer endorsements, or community campaigns can send prices up or down quickly within hours or even minutes.

Where can I find live Pepe Coin price charts?

Major exchanges, as well as crypto data aggregators like CoinMarketCap and CoinGecko, provide real-time price charts, trading volumes, and historical price data for PEPE. These platforms also include technical indicators commonly used for trading analysis.

Is Pepe Coin a safe investment?

Meme coins like PEPE are highly speculative, with prices that can swing dramatically on sentiment alone. Potential investors should recognize the risks, do thorough research, and never invest more than they can afford to lose.

How does Pepe Coin compare to Dogecoin and Shiba Inu?

While PEPE shares meme origins with DOGE and SHIB, it features its own distinct branding and community culture. Its tokenomics and volatility profile are similar, but each coin’s popularity cycles with different online trends and movements.

Can I use PEPE for anything beyond trading?

Currently, most use cases for PEPE are centered on trading and speculation. While some community-led projects have explored NFT integration or digital collectibles, practical everyday usage remains limited.

Certified content specialist with 8+ years of experience in digital media and journalism. Holds a degree in Communications and regularly contributes fact-checked, well-researched articles. Committed to accuracy, transparency, and ethical content creation.