Inj

INJ Price | Live Injective Token Value, Chart & Market Analysis

The INJ price has emerged as one of the most closely watched metrics in the world of decentralized finance (DeFi). As the native token of the Injective Protocol—a blockchain purpose-built for finance—INJ’s performance provides a real-time pulse on both the project’s traction and DeFi adoption at large. With widespread attention from traders, investors, and developers, understanding the main factors influencing live INJ price action is vital for market participants aiming to navigate the rapidly evolving digital asset market.

The Role of Injective Protocol in Shaping INJ Price

Injective Protocol set out to solve a core problem in crypto: enabling fully decentralized, permissionless, and high-performance trading across assets. Leveraging the Cosmos SDK and an innovative Layer 1 approach, Injective offers lightning-fast trade execution, near-zero gas fees, and interoperability with major blockchains—making it a foundational layer for a new generation of financial dApps.

The INJ token underpins this ecosystem. It serves various roles, including:

- Staking: Securing the network via delegated proof-of-stake.

- Governance: Empowering holders to vote on protocol upgrades.

- Utility: Facilitating fee payments, market creation, and incentivizing liquidity.

These fundamentals ensure that growth in network activity—more users, higher trading volume, and expanded use cases—translates into greater demand (and often, volatility) for INJ.

Historical Performance: Charting INJ’s Price Journey

Since its first listing in late 2020, INJ has experienced notable price movements, reflecting broader trends in both the crypto and DeFi cycles. The token reached all-time highs during key boom periods, but also showed resilience during industry-wide corrections.

Key Phases in INJ Price History

- Initial Surge: Upon launch, INJ benefited from DeFi hype, listing momentum, and strong backing from major exchanges.

- Expansion and Integration: Strategic partnerships, such as integrations with Binance Smart Chain and Ethereum, spurred renewed interest.

- Bear Market Resilience: Despite crypto downturns, Injective’s expanding dApp ecosystem and mainnet upgrades helped INJ avoid the sharpest declines seen elsewhere.

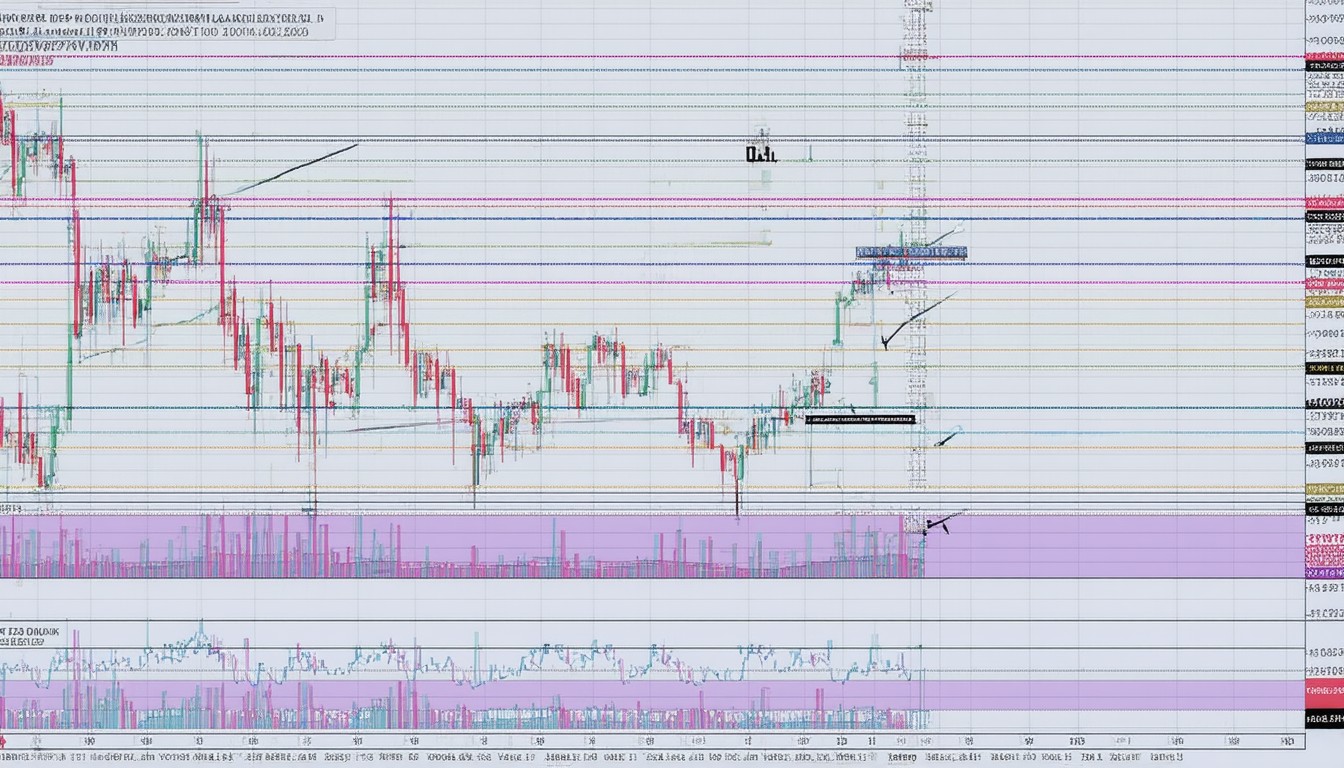

Price chart analysis over these timeframes highlights periods of doubled or even tripled valuations within months—mirroring the burst of innovation in DeFi but also the risks of heightened volatility.

As Matt Hu, a blockchain markets analyst, summarized:

“Injective’s INJ token is a textbook example of how utility, community, and institutional confidence intersect to drive real-world value for a digital asset.”

Live INJ Price Analysis: Volatility, Volume, and Sentiment

Beyond historical context, real-time price monitoring reveals the interplay of liquidity, market sentiment, and macro factors. Trading volumes on leading exchanges—such as Binance, Coinbase, and decentralized platforms—often act as barometers for INJ demand. Significant spikes frequently align with:

- Protocol upgrades or feature launches

- Exchange listings or cross-chain expansions

- Major “DeFi seasons” with surging user activity

Correlation With Crypto Market Trends

Like much of the DeFi sector, INJ price tends to correlate with overall crypto market momentum, though unique catalysts can create outperformance. For instance, bullishness around decentralized perpetuals or successful Injective-based dApp launches can drive short-term surges even in sluggish markets.

On-Chain Metrics That Matter

Traders often look beyond price charts to on-chain indicators like staking participation rates, total value locked (TVL) in Injective dApps, and wallet activity. Long-term price sustainability typically hinges on:

- Robust and growing protocol adoption

- Consistent developer activity and innovation

- Healthy, distributed tokenomics

Market Analysis: Factors Impacting INJ Price Futures

The forward path for INJ price will be shaped by a confluence of project milestones and macroeconomic dynamics.

Ecosystem Growth and Roadmap Progress

Ongoing protocol developments and ecosystem initiatives play a significant role. Key factors to watch include:

- New dApp and market launches: Bringing fresh use cases and users

- Interoperability advances: Integration with more Layer 1/2 chains

- Partnerships and institutional adoption

Regulatory Environment

As with all digital assets, evolving global regulatory approaches to DeFi can introduce both risk and opportunity. Frameworks legitimizing decentralized exchanges or enabling easier fiat on-ramps could unlock wider adoption, potentially boosting INJ demand.

Competitive Landscape

While Injective’s technical model sets it apart, the broader DeFi space is crowded. Projects like dYdX, GMX, and Uniswap are constantly rolling out upgrades. Injective’s continued growth—as measured by developer activity, unique addresses, and trade volume—will remain central to its competitive positioning.

INJ Price Charting Tools and Analysis Strategies

Staying informed on live INJ price moves requires robust charting platforms and clear analytical frameworks.

Top Platforms for INJ Price Tracking

Investors and traders use a mix of centralized and decentralized tools:

- CoinMarketCap/CoinGecko: Offer real-time price, volume, and historical charts

- DEX Statistics: In-depth data for volume and liquidity on decentralized exchanges

- TradingView: Advanced charting with technical analysis overlays

Strategies for Navigating INJ Price Volatility

Successful traders and analysts adopt a blended approach:

- Technical analysis: Identifying trends, breakout zones, and support/resistance levels

- Fundamental monitoring: Tracking protocol upgrades, governance votes, and market news

- Sentiment analysis: Gauging community mood and major holder movements

For mid- to long-term investors, a focus on project fundamentals and macro trends often outweighs the impact of daily price swings.

Conclusion: What’s Next for INJ and Its Market Value?

The INJ price is more than a ticker—it’s a reflection of Injective’s journey, DeFi sector vitality, and evolving market dynamics. As the project continues to broaden its ecosystem and deepen platform integration, INJ’s utility and demand may see further acceleration. However, ongoing volatility and broader crypto market sensitivity mean price watchers and participants must combine informed analysis with prudent risk management.

Keeping pace with live INJ price charts, understanding underlying catalysts, and engaging with community and governance remain central to any strategy—whether trading short-term or investing for the long haul.

FAQs

What affects the live INJ price the most?

INJ price is influenced by protocol developments, overall market sentiment, trading volume, and broader cryptocurrency trends. Specific news like listings or feature releases can cause notable price swings.

How can I track INJ price in real time?

Major crypto tracking sites like CoinMarketCap, CoinGecko, and TradingView offer real-time INJ price charts, trading history, and other key market data.

Is INJ a good investment for long-term holders?

Any investment involves risk, especially in the volatile crypto sector. Many long-term holders watch Injective’s roadmap, adoption rates, and ecosystem growth to inform their outlook.

What’s unique about the Injective Protocol compared to other DeFi platforms?

Injective stands out through its high-speed, low-fee trading infrastructure, interoperable design (via Cosmos), and a strong focus on decentralized derivatives and financial dApps.

How does staking impact INJ price?

When more INJ is staked, it often reduces circulating supply and can support price stability. Higher staking rates can also signal investor confidence in the protocol.

Where can I learn more about Injective and INJ price trends?

The official Injective website, social channels, and reputable crypto analysis platforms are useful sources for updates, insights, and community discussions around INJ token value and market developments.

Expert contributor with proven track record in quality content creation and editorial excellence. Holds professional certifications and regularly engages in continued education. Committed to accuracy, proper citation, and building reader trust.