Price

Robinhood Stock: Price, Performance, and Investment Insights

Over the past decade, Robinhood has become a household name among retail investors. Launched in 2013, the platform disrupted the traditional brokerage model by introducing commission-free trading, appealing to a generation of investors hungry for accessibility and simplicity. The company’s public debut—Robinhood Markets, Inc. (NASDAQ: HOOD)—marked one of the most closely watched IPOs in recent years, capturing the intersection of fintech innovation and the surging interest in self-directed investing.

In a rapidly evolving financial landscape, the “Robinhood stock” narrative is about more than just price charts and earnings releases. It speaks to changing investor behaviors, regulatory challenges, and the future of democratized finance. Here, we explore Robinhood’s stock performance, analyze key investment considerations, and offer context for those weighing its longer-term prospects.

Robinhood’s Stock Price Performance: A Volatile Market Debut

When Robinhood went public in July 2021, anticipation was sky-high. The company’s initial share price opened at $38, reflecting both its massive user base and the surge in retail investing during the pandemic era. However, the months that followed were marked by volatility. The stock quickly experienced dramatic swings—plunging below its IPO price within a week, then surging after rumors of crypto integration and fresh retail interest.

A Closer Look at HOOD’s Historical Performance

Robinhood’s share price has reflected broader market attitudes towards fintech, regulation, and the retail trading boom. After peaking in the high $70s just days post-IPO due to meme stock momentum and speculative interest, HOOD has faced downward pressure. Key contributing factors include:

- Regulatory scrutiny over payment for order flow (PFOF), Robinhood’s primary revenue engine.

- A normalization in trading volumes post-pandemic as market enthusiasm cooled.

- Wider sector shifts affecting growth stocks, especially higher interest rates and risk-off sentiment since late 2021.

By 2023, Robinhood’s stock price had stabilized compared to its early rollercoaster, trading at a fraction of its initial highs but with less wild day-to-day fluctuation. For some, these price movements highlight the challenges of investing in high-profile fintech disruptors. For others, they represent opportunity amid uncertainty.

Key Financials and Growth Metrics

Understanding Robinhood’s value proposition requires a close look at its fundamentals. As of its latest financial releases, Robinhood reports millions of active users and a steady base of funded accounts. While its user growth has slowed from the pandemic peak, customer engagement—measured by trading activity and assets under custody—remains robust relative to traditional brokerages.

Revenue Streams and Business Model

Robinhood’s financial health relies on several core streams:

- Payment for Order Flow (PFOF): This has traditionally been the largest revenue driver, though its future remains uncertain due to regulatory debates.

- Interest income: Especially as higher rates improved net interest margins, lending out idle client cash has become increasingly lucrative.

- Premium offerings: Robinhood Gold, a subscription service, adds another layer of recurring revenue.

Regulators’ attention, especially from the SEC, has prompted the company to explore diversification—such as crypto trading and retirement accounts—to mitigate risk tied to PFOF.

“The sustainability of Robinhood’s business hinges on its ability to innovate beyond zero-commission trading,” notes fintech analyst Maria Zhang. “In a landscape where regulatory pressure and competition are intensifying, product diversification is no longer optional—it’s essential for long-term value creation.”

Recent Earnings Trends

Recent quarters have shown Robinhood inching closer to profitability, with operating losses narrowing and new product lines contributing to top-line growth. However, competition remains fierce, from legacy giants like Charles Schwab to nimble newcomers in the digital asset space.

Investment Insights: Opportunities and Risks

For those considering an investment in Robinhood stock, balancing optimism with caution is key. Several themes dominate the investment thesis.

Opportunities and Growth Drivers

- Gen Z and Millennial appeal: Robinhood’s intuitive interface has helped capture younger demographics, a cohort likely to increase assets as their wealth grows.

- Expanding product catalog: Offering cryptocurrency trading, retirement accounts, and other capabilities aligns Robinhood with evolving customer needs.

- Fintech partnerships and integrations: Enhanced data analytics, social investing features, and financial education could drive higher engagement and monetization.

Major Risks and Headwinds

- Regulatory Overhang: Ongoing debates about PFOF introduce uncertainty to Robinhood’s largest revenue line. Any future bans or limitations could reshape the business model.

- Market sensitivity: A decline in retail trading activity across equities and crypto would reduce Robinhood’s commission-free advantage.

- Brand trust and user retention: Growing pains—from system outages to high-profile user complaints—have tested Robinhood’s reputation, making user trust a core metric to monitor.

In practice, the Robinhood stock story serves as a barometer for investor sentiment towards fintech democratization. It is not purely a financial trade, but also a play on broader market trends and policy outcomes.

Case Example: Robinhood’s Response to the “Meme Stock” Phenomenon

The 2021 meme stock frenzy, spearheaded by GameStop, AMC, and others, put Robinhood at the epicenter of a market revolution. The surge in activity caused operational strain and prompted the company to temporarily restrict certain trades, a move that drew strong criticism from its user base and lawmakers.

While Robinhood managed to weather the controversy, the episode underscores the volatility inherent in platforms powered by retail sentiment. Since then, the company has invested heavily in infrastructure, compliance, and customer communication, aiming to prevent similar crises and restore investor confidence.

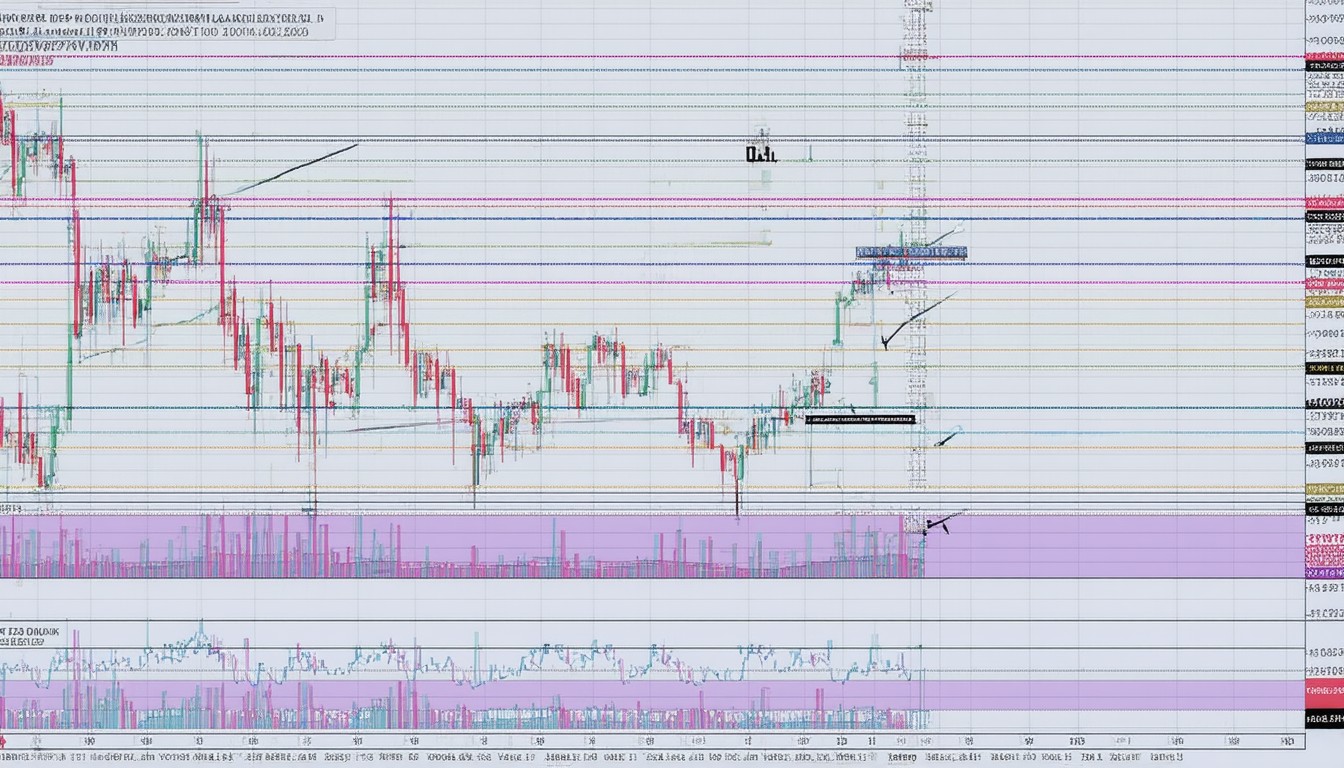

Technical Analysis Perspectives

From a technical analysis standpoint, Robinhood’s price action reflects its position as a sentiment-driven momentum stock. Key levels to watch often include:

- Support around multi-month lows: Providing a potential base for accumulation by value-oriented investors.

- Resistance at post-IPO highs: Often reinforced by news-driven rallies related to new features or earnings surprises.

- Volume trends: Spikes frequently accompany meme-driven trading cycles, while declining volume can signal consolidation periods.

While pure technicals offer insight, the unique interplay between regulation, product innovation, and user adoption drives Robinhood’s future trajectory as much as charts or indicators.

Conclusion: Balancing Innovation, Volatility, and Regulatory Change

Robinhood has fundamentally reshaped the investing landscape for a new generation. Its stock, meanwhile, embodies both the promise and perils of rapid fintech innovation. While significant risks—especially from the regulatory side—remain, ongoing efforts to diversify products and revenue streams may position Robinhood for resilience.

Investors should weigh the volatility, closely monitor policy developments, and assess whether their risk tolerance matches the sometimes unpredictable nature of this high-profile fintech stock. As always, a longer-term perspective—anchored by fundamentals and an understanding of industry shifts—is vital for anyone considering exposure to Robinhood in their portfolio.

FAQs

What is Robinhood’s main source of revenue?

Robinhood primarily earns revenue through payment for order flow, where it receives compensation from market makers for routing trade orders. It also generates income from interest on customer balances and premium subscription services.

How has Robinhood stock performed since its IPO?

Robinhood’s share price was highly volatile post-IPO, initially rising amid retail enthusiasm before declining due to regulatory concerns and changing market sentiment. More recently, the stock has stabilized but remains below its debut highs.

What are the biggest risks to investing in Robinhood stock?

Key risks include regulatory uncertainty, especially regarding payment for order flow, competitive pressures from other fintechs and brokerages, and reliance on retail trading activity, which can be unpredictable.

Is Robinhood profitable?

While Robinhood has reported narrowing losses in recent quarters and growing revenue streams, it has not consistently posted net profits. The company is working toward sustainable profitability through diversification.

How does Robinhood differentiate itself from other brokerages?

Robinhood stands out by offering commission-free trading and an intuitive, mobile-first interface appealing to younger investors. Its innovation in democratizing access to markets set a new industry standard, though others have since followed suit.

Where can I find the latest Robinhood stock price?

Current Robinhood share prices can be tracked via major financial news sites, brokerage platforms, and by searching for its NASDAQ ticker: HOOD. Always refer to real-time market data before making investment decisions.

Certified content specialist with 8+ years of experience in digital media and journalism. Holds a degree in Communications and regularly contributes fact-checked, well-researched articles. Committed to accuracy, transparency, and ethical content creation.