Hbar

Hedera Price | Live HBAR Value, Chart & Market Analysis

Hedera Hashgraph, often referenced by its token HBAR, has evolved as an alternative to traditional blockchain networks. Unlike blockchain’s sequential data blocks, Hedera operates on a directed acyclic graph (DAG), known as Hashgraph, which underpins its efficiency, consensus, and security. This novel technology promises high throughput, low-latency, and fair ordering, targeting applications demanding scalable enterprise-grade distributed ledgers.

Key features influencing Hedera price movements include:

- Transaction Speed: Boasting the ability to handle thousands of transactions per second, Hedera offers speed that rivals traditional payment networks.

- Energy Efficiency: The Hashgraph consensus uses a fraction of the energy of Proof-of-Work chains, attracting sustainability-minded developers and enterprises.

- Enterprise Governance: A unique Governing Council structure, with members such as Google, IBM, and Deutsche Telekom, sets policies and oversees network changes, aiming to bolster institutional trust.

Institutional involvement has played a visible role in Hedera’s narrative. When major council members announce new projects or integrations, positive momentum can be observed in HBAR’s valuation, reflecting confidence from established brands.

Live HBAR Value: Tracking Real-Time Market Movements

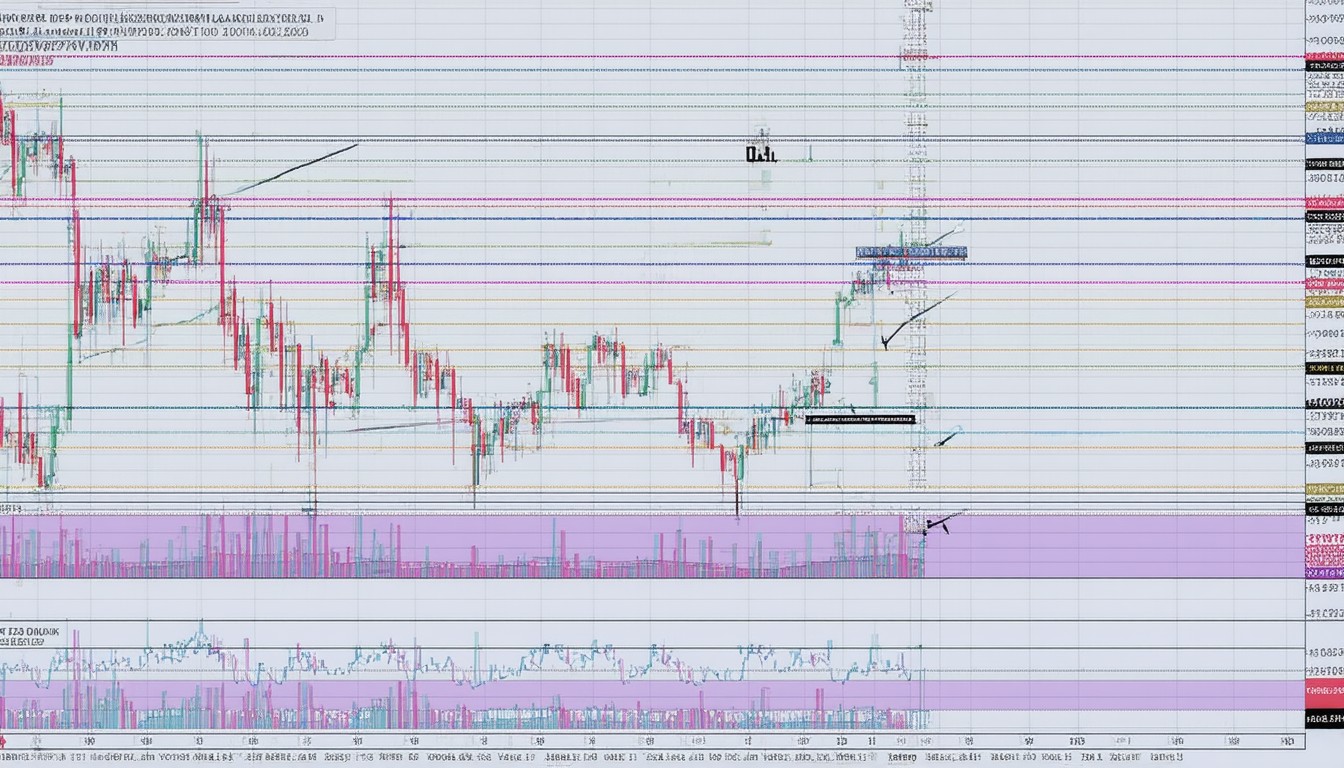

The HBAR price fluctuates in real time across global crypto exchanges, shaped by diverse market forces. Most platforms display HBAR’s market value as a pairing with leading currencies like USD, BTC, or ETH, and chart its movements minute by minute—data that is indispensable for traders and institutional participants alike.

Several tools and platforms provide live Hedera price feeds, including:

- CoinMarketCap and CoinGecko: Aggregated charts and historical performance data.

- Crypto exchanges such as Binance and Kraken: Real-time candlestick charts, trading volume, and order book depth.

- API-powered dashboards for developers and institutions.

Intraday volatility is not uncommon for HBAR and other major altcoins, driven by news cycles, broader industry trends, and liquidity movements. For instance, significant protocol upgrades or reports of new enterprise use cases can result in double-digit price swings within hours.

“Monitoring live price data and on-chain activity is essential for understanding momentum in digital asset markets, especially for tokens like HBAR where enterprise adoption often serves as a primary catalyst,” notes crypto market analyst Jenna Lee.

Recent Performance Trends and Price Chart Analysis

Historical Price Movements

Since its network launch, HBAR has experienced several distinct price cycles. Early trading was marked by gradual adoption, followed by more pronounced rallies as major council members and enterprise pilots were announced. Like many Layer 1 projects, HBAR saw a substantial bull run during the broader 2021 crypto boom, with price increases mirroring heightened developer activity and speculative interest.

Technical Patterns and Indicators

Common price chart analyses of HBAR often reveal:

- Support and resistance levels: Notable zones where buying or selling pressure has historically concentrated.

- Relative Strength Index (RSI): Useful for spotting overbought or oversold conditions, with rapid shifts often preceding corrections or new trend formations.

- Moving Averages (MA): Short- and long-term averages help smooth volatility, highlighting potential entry and exit points for traders.

For instance, after a period of consolidation in mid-2023, a significant uptick in transaction volume and new enterprise partnerships fueled renewed upward momentum, propelling HBAR through previous resistance levels.

Core Factors Shaping Hedera Price

Macro Market Sentiment

Like most digital assets, HBAR’s price is sensitive to broader market sentiment. Periods of risk-on appetite among investors, often fueled by positive developments in the wider crypto sector or regulatory clarity, tend to benefit HBAR. Conversely, global economic uncertainty or adverse regulatory headlines can drive outflows from risk assets, contributing to price drawdowns.

Network Development and Ecosystem Growth

HBAR’s valuation is closely linked to network utility:

- Launch of new decentralized applications (dApps) increases on-chain activity.

- Expansion of the Hedera ecosystem, particularly via partnerships with Fortune 500 firms, generates media coverage and investor attention.

- Tokenomics—such as scheduled unlocks, staking rewards, and fee models—shape circulating supply and thus price dynamics.

Technical Upgrades and Security

Major protocol updates, especially those enhancing performance or security, can be inflection points for price action. For example, the introduction of native NFT support or improved smart contract capabilities often correlates with trading surges.

Comparing HBAR with Other Layer 1 Assets

Hedera’s unique technical foundation and governance model differentiate it from other Layer 1 competitors like Ethereum, Solana, or Algorand. While Ethereum dominates by developer count and established dApps, Hedera positions itself as a solution for enterprises prioritizing speed and transparency.

Case in point: unlike Ethereum’s congestion-induced slowdowns, Hedera’s throughput remains consistent, appealing to large-scale commercial pilots in supply chain, payments, and advertising. Yet, lower decentralization relative to permissionless networks is sometimes raised as a risk by segments of the crypto community.

“Enterprises are looking for performance and predictability, and Hedera’s council-governed architecture gives them the stability and roadmap assurance they desire—an edge for institutional adoption,” emphasizes digital assets economist Maritza Powell.

The Outlook: What’s Next for HBAR Price?

Looking ahead, several factors are likely to shape the trajectory of HBAR price action:

- Continued Institutional Adoption: As more blue-chip companies deploy Hedera-based solutions, credibility and token demand may see further boosts.

- Regulatory Evolution: Emerging legal frameworks—whether friendly or restrictive—will have knock-on effects on market appetite for HBAR and similar assets.

- Ecosystem Innovation: The development of apps in DeFi, supply chain, tokenization, or compliance records will determine utility and, ultimately, the value captured by HBAR holders.

Long-term investors keep a close watch on the expansion of real-world use cases beyond speculation. As with all digital assets, price remains volatile, with progress best measured in tracked adoption and transaction metrics alongside headline market moves.

Conclusion

Hedera Hashgraph stands out in the competitive digital ledger space with its Hashgraph consensus, enterprise focus, and institutional governance—qualities that heavily influence both adoption and price behavior. While HBAR offers unique value through technology and partnerships, its market price is steered by factors ranging from technical innovation to macroeconomic trends. Savvy investors and observers watch not only the live price but also the underlying development that signals Hedera’s role in the evolving decentralized economy.

FAQs

What determines the live price of HBAR?

The live price of HBAR reflects trading activity on global exchanges, supply and demand, overall market sentiment, and news related to both Hedera’s technology and the broader crypto sector.

How can I track Hedera’s price and historical charts?

HBAR’s current value and historical performance can be tracked on major crypto data platforms like CoinMarketCap or CoinGecko, as well as on leading exchanges offering advanced charting tools.

Why do enterprises choose to build on Hedera?

Enterprises are often attracted to Hedera’s high throughput, low energy use, predictable fees, and governance by leading international firms, making it suitable for scalable, mission-critical applications.

How does Hedera’s price differ from Bitcoin or Ethereum?

HBAR is less established than Bitcoin or Ethereum and exhibits unique price drivers due to its technology, governance, and focus on enterprise-grade applications, often experiencing different patterns of volatility.

What are the risks in HBAR price speculation?

Risks include technological shifts, evolving regulations, market competition, and the pace of actual enterprise adoption. As with all cryptocurrencies, HBAR’s price is subject to sharp fluctuations.

Where can I buy or trade HBAR?

HBAR is available on major crypto exchanges including Binance, Kraken, and others, allowing users to trade or invest using various fiat and crypto pairs.

Established author with demonstrable expertise and years of professional writing experience. Background includes formal journalism training and collaboration with reputable organizations. Upholds strict editorial standards and fact-based reporting.