Dot

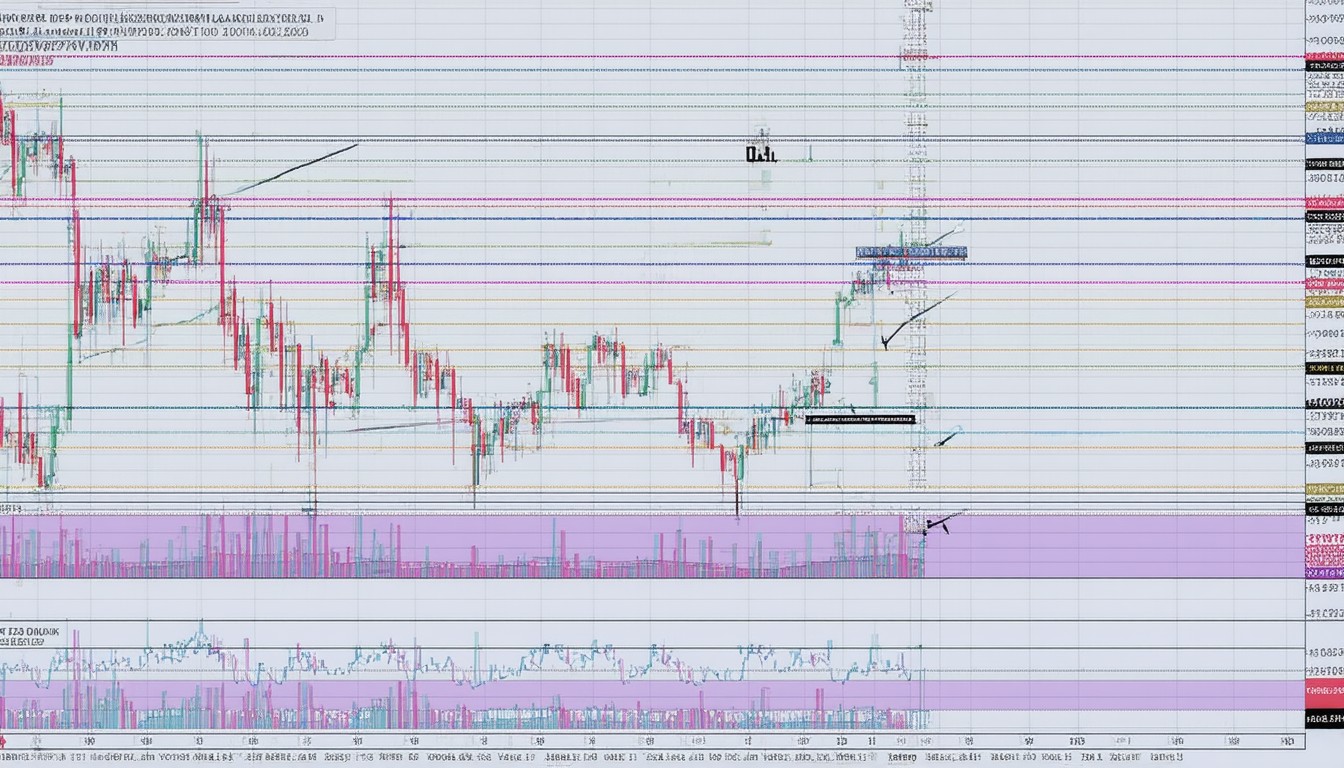

Polkadot Price | Live DOT Value, Market Trends & Analysis

Track the live Polkadot (DOT) price, explore current market trends, and gain expert insights into Polkadot’s value drivers. This in-depth analysis covers historical performance, volatility, and what influences DOT’s price in today’s crypto markets.

Understanding Polkadot Price: A Dynamic Market Landscape

For many investors and blockchain enthusiasts, Polkadot (DOT) sits at the intersection of technological ambition and market volatility. As a multichain platform, Polkadot strives to enable diverse blockchains to interoperate, offering innovative scaling and governance features. These technological goals and Polkadot’s evolving ecosystem have a direct influence on its token price—often creating both excitement and uncertainty among market participants.

Like many top crypto assets, Polkadot has demonstrated price swings driven by broader digital asset sentiment, protocol updates, and macroeconomic shifts. To understand the current and future directions of DOT’s price, it’s critical to examine key price movements, market trends, and the underlying value drivers that make Polkadot both promising and unpredictable.

Live DOT Value: Key Metrics and Real-Time Price Movements

Prices in crypto markets rarely sit still, and DOT is no exception. Its value is shaped by real-time trading, regulatory developments, and network-specific events. Since its initial public listing, DOT has traded on major exchanges—changing hands millions of times per day.

Factors Impacting Real-Time Value

-

Market Liquidity:

DOT’s price benefits from deep liquidity pools offered by top exchanges. High trading volumes typically mean tighter spreads, but sudden shifts in sentiment can spark rapid price fluctuations. -

Exchange Listings:

New exchange integrations frequently cause short-term price spikes by increasing DOT’s accessibility to new investor groups. -

Release of Parachains:

As Polkadot adds new parachains—specialized blockchains joining its ecosystem—these launches can boost network activity and, by extension, investor optimism.

The Live Price View

Investors closely watch price feeds on platforms like Binance, Coinbase, and Kraken for the latest DOT price in USD, BTC, and other paired assets. These platforms update in seconds, reflecting the intense speed and transparency characteristic of crypto markets.

Market Trends: How DOT Compares and Why It Matters

Polkadot is often discussed alongside other so-called “Ethereum killers.” While each chain has its unique roadmap, DOT’s market trends reveal how competitive and evolving the sector has become.

Polkadot vs. Ethereum, Cardano, and Solana

-

Interoperability Strengths:

Unlike most Layer-1s, Polkadot’s design focuses on interoperability, enabling seamless communication across blockchains. This technical differentiation shapes investor expectations and thus affects price action. -

Ecosystem Comparisons:

While Ethereum dominates decentralized application (dApp) activity, Polkadot’s potential lies in attracting new projects via its parachain auctions and stability-focused governance. -

Volatility and Correlation:

DOT’s price often follows broader crypto trends—spiking during bull runs but also exposed to deep corrections when sentiment turns sour.

“Polkadot’s versatility, especially its parachain system, continues to draw both developer interest and speculative capital. This dynamic is reflected in its price, which tends to move in anticipation of major network milestones.”

— Susan Li, Crypto Analyst at Ledger Insights

Key Price Drivers: What Moves DOT’s Price?

A closer look at Polkadot’s market reveals several factors that consistently play an outsized role in determining price trends.

Network Upgrades and Technical Milestones

Major protocol upgrades—like the rollout of parachains or governance changes—often serve as bullish catalysts. The anticipation and successful execution of these updates signal robust project development and can ignite upward price momentum.

Staking and Token Supply

DOT’s staking mechanism is integral to Polkadot’s security and governance. Staking participation impacts token liquidity, reducing available supply on exchanges and potentially supporting higher prices during periods of strong network engagement.

Regulatory Headlines and Sentiment

As a large-cap digital asset, DOT’s price can swing on news regarding regulatory scrutiny of the broader crypto sector. Announcements from major financial authorities in the US, EU, or Asia can spark both optimism and risk aversion among DOT holders.

Broader Crypto Market Moves

Much like other coins, DOT is subject to overall digital asset trends. High correlations with Bitcoin and Ethereum mean that DOT frequently moves in tandem with the direction of large-cap crypto sentiment—whether up or down.

Historical Performance and Volatility Patterns

Examining DOT’s price history provides valuable perspective on its growth trajectory and risk characteristics.

Key Milestones in DOT Price History

-

Initial Surge:

DOT made headlines with strong early price performance shortly after its mainnet launch and subsequent redenomination in 2020, benefiting from the broader DeFi boom. -

Bull Runs and Corrections:

DOT’s all-time highs often aligned with crypto’s most exuberant periods, while downturns have mirrored sector-wide corrections in 2021 and 2022. -

Resilience and Recovery:

Throughout repeated cycles, DOT has demonstrated the capacity to bounce back, as developer activity and new parachain launches renewed market confidence.

Volatility: Risk and Reward

Polkadot’s price can experience double-digit moves in single trading sessions during periods of heightened volatility. For traders, this offers both opportunity and risk. Long-term holders, meanwhile, may view such swings as part of the crypto sector’s growing pains.

Conclusion: Navigating Polkadot’s Price in a Rapidly Shifting Market

The price of Polkadot is a moving target shaped by a blend of network innovation, ecosystem growth, market psychology, and global regulatory currents. Staying informed about live prices, upcoming upgrades, and the overall crypto sentiment allows market participants to make reasoned, timely decisions.

For those looking to invest or engage with the Polkadot ecosystem, vigilance and adaptability remain paramount. As blockchain technology and market frameworks mature, the true value of interoperable networks like Polkadot will continue to come into clearer focus.

FAQs

What influences the price of Polkadot (DOT)?

Several factors impact DOT’s price, including major network upgrades, staking participation, overall crypto market trends, and global regulatory developments. Local events like parachain launches can also create short-term price volatility.

How often does the DOT price change?

DOT trades 24/7 and its price updates in real-time on every major exchange. This means prices can fluctuate within seconds, reflecting ongoing changes in market demand and sentiment.

How does staking DOT affect its price?

Staking reduces the circulating supply of DOT on exchanges, as tokens are locked for network security and governance purposes. When a significant amount of DOT is staked, it can create upward pressure on price, especially during periods of high network activity.

Is DOT more volatile than other cryptocurrencies?

DOT’s price volatility is similar to that of other Layer-1 tokens and often correlates closely with broader cryptocurrency market swings. While it experiences significant price moves, this is typical of leading digital assets.

Where can I see live Polkadot price updates?

Live price updates for DOT are available on leading cryptocurrency exchanges such as Binance, Coinbase, and Kraken, as well as on data aggregation platforms like CoinMarketCap and CoinGecko. These platforms provide real-time price, volume, and historical charts.

What makes Polkadot different from Ethereum?

Polkadot’s primary distinction is its focus on interoperability, allowing multiple blockchains to communicate and share data within its network. While Ethereum is known for its extensive dApp ecosystem, Polkadot’s parachain architecture aims to foster specialized networks that connect seamlessly.

Experienced journalist with credentials in specialized reporting and content analysis. Background includes work with accredited news organizations and industry publications. Prioritizes accuracy, ethical reporting, and reader trust.